While every ecommerce enterprise can turn to its balance sheet to see the cost of fraud in dollars and cents, the numbers on the page go only so far in telling the whole story.

As Forrester points out in its June 2017 “Total Economic Impact of Guaranteed Fraud Protection,” a commissioned study conducted by Forrester Consulting on behalf of Signifyd, the costs can bleed into nearly all aspects of a business. For businesses without an automated system to detect fraud and manage bad orders, the identifiable costs alone include:

- Fines charged by banks when a fraudulent order results in a credit card company refunding a consumer’s money — known in the industry as a chargeback.

- Administrative time related to accounting for and paying the chargeback.

- Time employees spend monitoring suspicious orders in an effort to prevent fraud — especially when such monitoring falls outside of their core responsibilities.

- Revenue lost when an order is cancelled for fear of fraud, even though the order was actually legitimate.

- Revenue lost when a legitimate customer cancels his or her order because it’s been delayed due to a manual review.

And those are only the identifiable costs. Consider related costs, such as the morale-crushing effect of assigning customer-support employees to fraud monitoring tasks when what they want to do is help customers. Or consider those legitimate customers who cancel orders delayed by a manual review? What becomes of their lifetime value to the company? Do they ever order again? Do they order less frequently?

The commissioned Forrester Consulting report underscores the point by explaining that customer satisfaction scores among consumers who receive their orders in a timely fashion are considerably higher than those among customers whose orders are delayed by reviews. And it notes:

“That metric can be further extrapolated for items like customer retention, churn, lifetime value, and likelihood to promote or detract.”

Fraud-fighting struggles are familiar to retailers of all sizes

Forrester Consulting, of course, doesn’t deal in the theoretical. Its “Total Economic Impact of Guaranteed Fraud Protection for Merchants,” report, subtitled “Incremental Earnings, Chargeback Fraud Protection, And Fraud Management Efficiency Enabled by Signifyd,” examines a real-life example of a Signifyd customer that has nearly $100 million in annual online revenue.

The large retailer’s struggles with fraud will be familiar to digital commerce operations of all sizes. The company relied on a rules-based fraud system that required humans to review every suspect order. The retailer, which agreed to share proprietary information if it was not named, assigned customer support workers without fraud training to sort the good from the bad orders.

The work amounted to a “part-time” task for a group of workers who then couldn’t focus full-time on giving customers the kind of help and information they needed for an ideal customer experience.

Moreover, the system did not scale and was easily disrupted by personnel changes and a shift in fulfillment strategy that brought a drop-shipper into the picture — and a new order stream that wasn’t subject to the retailer’s existing fraud-prevention program.

The patched-together system resulted in fraudulent orders going through and — just as bad — led to legitimate orders being denied for fear of fraud.

Signifyd, which relies on a machine-learning system to identify fraudulent orders and green-light good ones, provided another way. The system considers a vast pool of data from Signifyd’s thousands of merchant customers and from third party data sets that surface signs that something in a particular order is amiss.

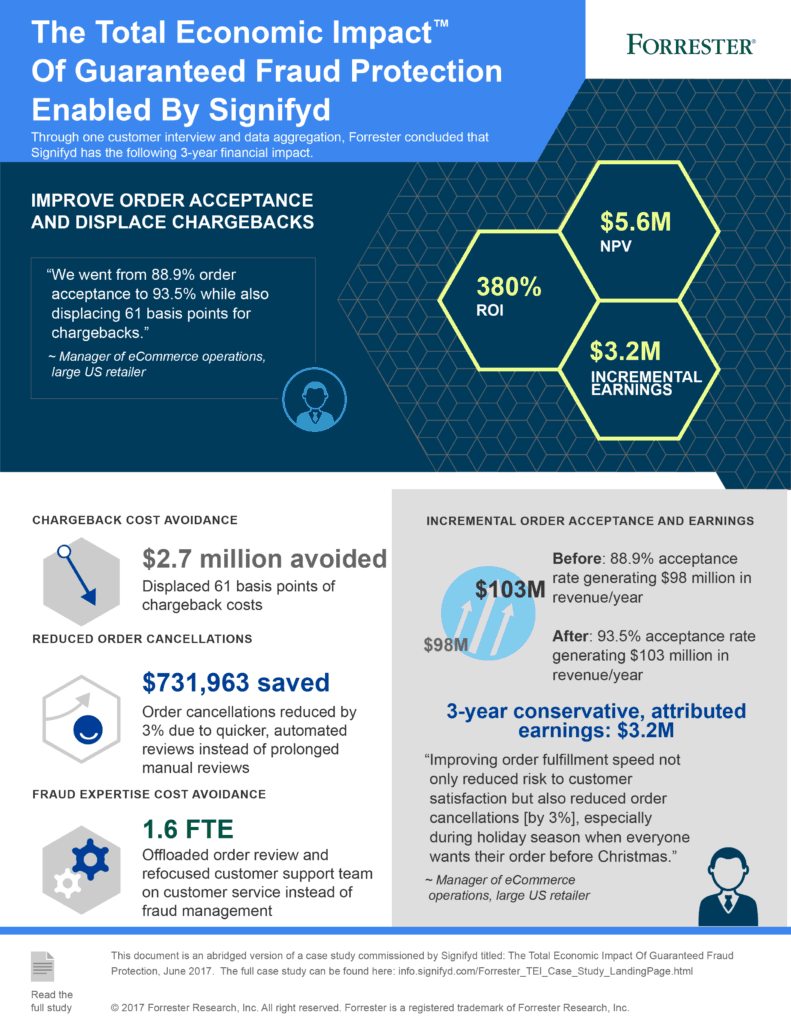

Switching to Signifyd and accepting the company’s Guaranteed Fraud Protection saved the retailer $2.7 million over three years by avoiding chargeback fraud, according to the commissioned report conducted independently by Forrester Consulting.

More importantly, the constantly learning technology allowed the company over three years to fill $3.2 million in good orders that previously would have been denied as potentially fraudulent, according to the commissioned report.

Signifyd saved retailer $1 million in operational efficiencies alone

Together the increased volume of accepted orders and the decrease in fraudulent orders leading to chargebacks accounted for most of the increased revenue and savings that the retailer realized by turning to Signifyd to battle fraud. The retailer generated slightly more than another $1 million in revenue and savings by filling orders faster and by avoiding the cost of hiring a team of fraud experts. In all, the retailer saw a three-times return on investment, according to Forrester Consulting’s commissioned report.

Like many things retail, the enterprise fraud-prevention infrastructure is a complex tangle of related causes and effects resulting in the difference between increased revenue and mounting losses. Getting it right is crucial, but conducting the necessary research and work isn’t necessarily the best use of time for those running a retail business.

So, it’s good to know there is help out there. Help from vendors, sure. But also help from independent researchers such as Forrester Consulting, whose body of work, including “Total Economic Impact of Guaranteed Fraud Protection,” can help demystify the vital functions that are not central to a retailer’s mission, but which can leave that mission in tatters if not wisely addressed.

Mike Cassidy is Signifyd’s lead storyteller. Contact him at [email protected]; follow him on Twitter at @mkecassidy.