Every California school kid knows that it wasn’t the miners who got rich during the Gold Rush. No, it was the companies that supplied them with picks, shovels and blue jeans that really cashed in.

The historical note is an imperfect analogy for those participating in California’s current Green Rush — the booming marijuana retail sales in the wake of the legalization of recreational marijuana on Jan. 1.

The truth is, legal pot sellers appear to be doing quite well in the Green Rush, but there are other merchants who stand to prosper as well: the online sellers of the accessories and paraphernalia that make consuming cannabis easier, more enjoyable or more efficient.

“Oh, they’re going to see a massive bump in sales,” says Glenn Ballman, founder and CEO of düber Technologies, a blockchain inventory and online sales platform for legal marijuana sellers and buyers. “The question is, ‘What happens when a state goes from medical to recreational? Do all boats rise at the same rate?’ And the answer is, yes. Whatever you were doing in medical, you’re going to be doing six to eight times that this year.”

Ballman, who spoke to me from düber’s Vancouver, Canada, office, saw the opportunity in legal marijuana when Prime Minister Justin Trudeau rode to victory on a platform that included legalization in 2015. As a result, it is likely that recreational marijuana will be legal nationwide in Canada beginning in July.

“That was a big wake-up call,” Ballman said, adding that some U.S. states, such as Colorado and Washington, had already legalized recreational pot by then.

Legal marijuana’s economic impact is set to take off

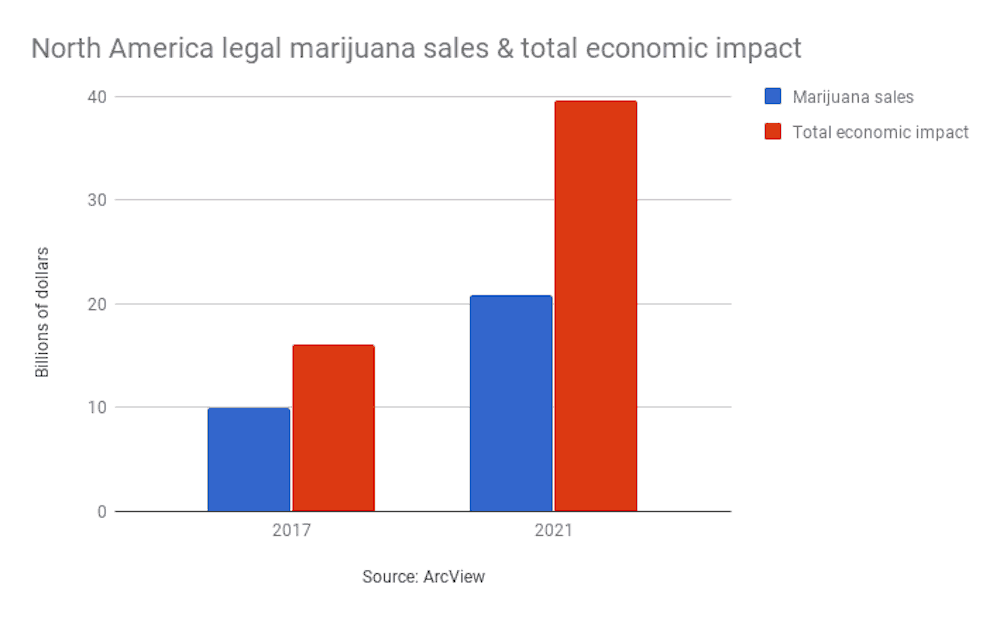

The total economic output from legal marijuana in the United States alone, which hit $16 billion in 2017, is projected to grow two-and-half times to $40 billion by 2021, according to ArcView Market Research. Marijuana sales themselves are expected to total $20.8 billion in 2021, the report says. The ecommerce potential for any other consumer product with those kind of sales would be hard to resist.

But when it comes to online sales, marijuana retailers, virtually all of which are small- or medium-sized businesses, face a number of challenges that other retailers don’t. While legal in some states, marijuana is still illegal under federal law. Therefore, shipping pot across state lines is prohibited. Nor can marijuana be transported by aircraft or boat, Ballman says.

Moreover, marijuana is a perishable product that lasts about eight weeks, he adds, meaning inventory information needs to be available in real-time. Oh, and reporting requirements mean farmers, retailers and distributors need to keep track of every gram they move. It can’t be sold or delivered to minors.

And traditional ecommerce is pretty much out of the question. Credit card transactions are virtually impossible because banks want no part of the marijuana business because it remains illegal under federal law.

The story is different for online retailers who sell only paraphernalia, such as vaporizing devices used to smoke cannabis concentrate. Their products are not illegal under federal law and, in fact, their products are also used for conventional vaping. They are able to accept credit cards for online sales, because they have access to banks. They can ship virtually anywhere they please. They are the “boats” that Ballman predicts will rise along with marijuana retailers.

Of course, with increased sales come increased challenges. A sudden increase in orders is always good news, but for many online merchants, it also means scrambling to come up with more help, more hours in the day and a need to scale up their ability to ferret out fraudulent orders among the good orders.

In fact, California’s Green Rush is a reminder that the winter holiday season is not the only time retailers need to be braced for a spike in orders. Sometimes it depends on the season for certain retailers —Valentine’s Day for jewelers, summer for sellers of barbecues and outdoor recreation gear, Easter and Mother’s Day for florists. And sometimes it depends on outside forces, such as the relaxation of marijuana laws.

Online fraud is rising for cannabis-related products

Online fraud was on the rise in the retail sector that includes cannabis paraphernalia even before California legalized recreational marijuana, according to Signifyd’s most recent published data. The overall fraud rate in the Alcohol, Tobacco and Cannabis sector, increased to 3.32 percent from 2.81 percent in a recent quarter-over-quarter comparison. The lion’s share involved stolen financials, in which fraudsters use stolen identity information to impersonate consumers. The stolen financials category reached 2.97 percent, up from 2.64 percent over the period studied.

Leading ecommerce merchants have turned to automation and a form of fraud management called Guaranteed Fraud Protection to allow them scale up for seasonal spikes. The best guaranteed models rely on machine learning and human intelligence to ensure that fraudulent orders are turned down, while orders that appear risky, but are actually legitimate, are shipped. And the guaranteed model shifts fraud liability away from the merchant, by providing a 100 percent financial guarantee on any approved order that later turns out to be fraudulent.

Signifyd customer Dr. Dabber, for instance, turned to machine-learning based Guaranteed Fraud Protection, after discovering that keeping tabs on fraud manually was an incredible time suck. President and co-founder Pantelis Ataliotis told us that before he deployed Signifyd’s fraud protection, he’d spend nearly an hour a day weeding out fraudulent orders at his vaporizer and accessory store — not his favorite task and not what he went into business to do.

“We were dealing with so many other things,” he said. “I mean it was a huge inconvenience, a huge hassle.”

It was a hassle he felt he had to endure because fraudsters were placing orders worth hundreds and even thousands of dollars, sometimes in waves that are common in full-fledged fraud attacks.

Guaranteed Fraud Protection increases ecommerce efficiency

But once Ataliotis activated Signifyd on his Shopify site, the time his team spent on fraud dropped to 10 minutes a day, he said.

Despite the limited potential of selling marijuana itself online, because of federal laws, Ballman and düber have enabled something of an online ecommerce option for marijuana sellers. düber avoids the banking problem by relying on cryptocurrency for transactions. And duber provides services that would be the envy of many traditional ecommerce retailers.

The düber platform allows growers and producers to keep track of how their products are selling in the stores using the platform. The stores, which generally are mom-and-pop sized, gain complete insight into their inventory. And customers know exactly what is in which store at what time, a feature that is crucial in a business that sells 16,000 unique products in Washington state, where düber operates, and 30,000 to 40,000 unique products in California, according to Ballman.

“We tap into the local inventory system, the point of sale system, that control the inventory inside the retail store,” Ballman says. “So imagine our system reaching out like a spider web every two or three seconds, pulling down the data from these points of sales from the stores and updating a master catalog, saying this is how much each of these stores have for this product.”

Consumers can then order online and know, when they go to pickup in store, that the store has exactly what they ordered. That works for delivery, too. Yes, stores on the duber platform can deliver online orders paid for with crypto-currency. Those who want their weed within half an hour pay an $8 delivery fee. Those who are willing to wait up to eight hours pay $5.

Ballman says the legal landscape has forced marijuana sellers to adopt an ecommerce strategy that many brick-and-mortar stores are turning to as a way to outfox Amazon.

“What cannabis is going to do, it’s going to skip all of the 20 years of Amazoning and it’s going to go straight to 2017, where you’re coordinating home delivery from local retail stores. That’s literally what duber does.”

You could say, that in a way, it’s providing the picks and shovels for a burgeoning industry.

Photo of smoke by iStock. Photo of marijuana plants, courtesy of Neon Tommy, published under Creative Commons license.

Contact Mike Cassidy at [email protected]; follow him on Twitter at @mikecassidy.