If the purpose of the stimulus payments included in the recently passed American Rescue Plan was to kick-start the economy, data from Signifyd’s Commerce Network indicates that it’s working.

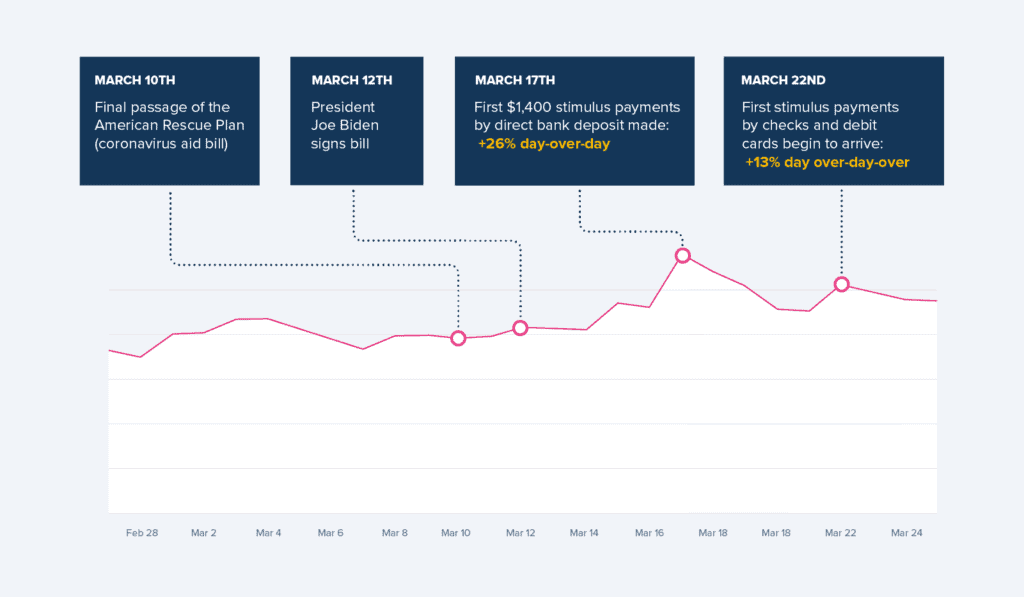

While ecommerce spending has been dramatically higher than pre-pandemic days for more than a year now, Signifyd’s Ecommerce Pulse data shows an additional, dramatic spike in mid-March spending that coincides with key events in the stimulus story.

If the purpose of the federal legislation signed by President Joe Biden on March 11, was to literally rescue Americans from dire circumstances, the numbers are less clear, judging from the categories that saw spending increases, according to Signifyd’s Ecommerce Pulse data.

Ecommerce spending increased markedly on days that payments of as much as $1,400 per person landed in bank accounts and mailboxes. On March 17, the day nearly 100 million consumers received direct deposit payments, for instance, ecommerce spending was 183% higher than it was on March 17, 2020. The spending spree continued on March 18, when online sales were 165% above sales on the same day the year before.

The story repeated itself on March 22, the first business day after the IRS started mailing paper checks and debit cards. On that day, ecommerce spending was up 129% year-over-year.

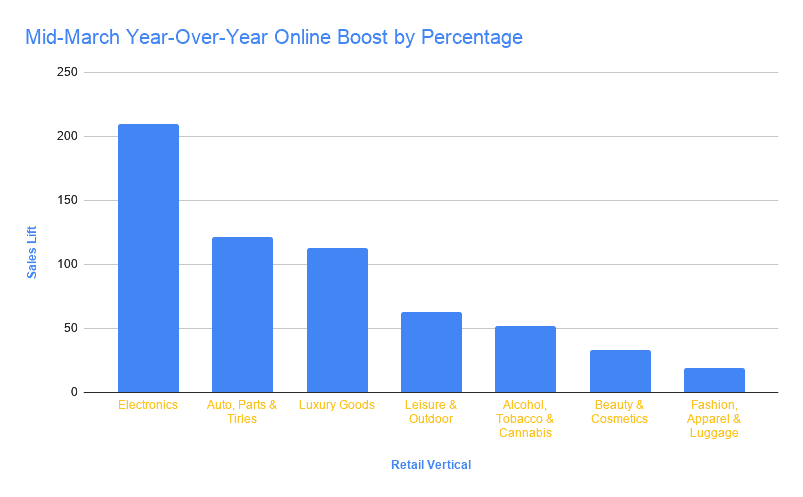

The big winners in terms of retail verticals were Electronics; Auto, Parts & Tires; Luxury Goods and Fashion, Apparel & Luggage — all of which saw online sales boom after stimulus payments were passed and signed into law.

Ecommerce spending jumped dramatically during the “stimulus period”

And while the one-day spending increases are eye-catching when it comes to consumer behavior and retail sales, it’s often more telling to step back and take a broader look. To help with that perspective, Signifyd identified a “stimulus period,” stretching from March 12, the day after Biden signed the most recent COVID relief bill, to March 25, a week into the mailing of stimulus checks and debit cards.

We compared the year-over-year growth in online spending from that period to the year-over-year growth in online spending for 2021 as a whole (up until March 25). From that vantage point, the year-over-year increases in certain key verticals during the stimulus period were striking. One note: Comparing the first quarter of 2021 to the first quarter of 2020 put several 2020 pre-pandemic weeks into the mix — meaning the stimulus effect was even greater than it might appear at first glance.

As the chart below shows, electronics sales were up 209% in the March stimulus period, compared to 109% for 2021 so far. For Auto, Parts & Tires, the numbers were 121% compared to 50%; for Luxury Goods the stimulus increase was 113%, compared to 40% and Fashion, Apparel & Luggage was up 19%, compared to being down 17% for the year-to-date period.

The overall spending increases tell a story. But an analysis of which verticals saw increases tells its own, more nuanced, story. We’ll start with dividing the verticals into retail categories that primarily reflect “wants” and categories that primarily reflect “needs.”

The reasons for stimulus spending are not clear cut

Granted, it’s impossible to know from the numbers themselves the reasons behind consumers’ purchases. And it remains unclear from ecommerce data whether the stimulus payments are rescuing consumers from dire circumstances.

For instance, current ecommerce data tells us only so much about spending on the most basic needs. Rent and mortgage payments would not be reflected in online data. And online sales in the Grocery & Household Goods vertical actually declined nearly 40% when you compare spending during the stimulus period to the same period in 2020.

But the grocery statistic could be deceiving. Two things to keep in mind with online grocery sales: The March 2021 numbers are being compared to a year-earlier time when grocery sales were off the charts. The early pandemic days were marked by dramatic Grocery & Household Goods stockpiling. Second, while online grocery ordering is quickly growing in popularity, the overwhelming majority of grocery shopping is still done in stores.

Nonetheless, it’s interesting to explore through the lens of consumers’ behavior whether the stimulus is rescuing online-shopping Americans from a lack of necessities required to stay safe, healthy, housed and employed or whether it’s rescuing them from boredom and sameness.

Using the wants-and-needs framework, most would agree that Auto, Parts & Tires fall into the necessity category. A well-functioning and reliable automobile is a key means for workers to get to their jobs. Cars have become the primary tool for gig workers — those providing ridesharing and the host of delivery and errand services that have become lifelines for many in the pandemic.

Necessity is in the eye of the consumer

Fashion, Apparel & Luggage certainly skew toward the need category, though admittedly the line blurs in places depending on just what kind of apparel is being purchased and for what purpose. Luxury Goods, by definition, tilt toward wants. Electronics are a mixed bag. No question, a functioning laptop and cell phone are necessities for a remote worker. Monitors, keyboards, printers, headphones and the like might also be needed for an efficient home office — or an efficient home schooling setup.

But some of those same electronic tools can be used for entertainment and no doubt are — if not solely, then in off-hours for workers and students. In the end, it’s a reminder that “needs” are often in the eye of the consumer.

The stimulus payments also apparently provided a boost to another pandemic-driven trend. During 2020, Signifyd saw a wave of new online shoppers embrace ecommerce. The number of new online shoppers transacting on Signifyd’s Commerce Network increased by more than 32% in 2020 compared to 2019, according to Signifyd’s “The State of Commerce 2021: Redefining Experiences for a New Wave of Customers.”

Another boost in new online shoppers — defined as a shopper not seen on Signifyd’s network of thousands of retailers for at least a year — coincided with the arrival of stimulus payments. In fact, the number of new shoppers transacting on Signifyd’s network was 40% higher during the stimulus period than it had been for the entire month of March.

There is little doubt, based on Signifyd’s data, that stimulus payments are being put into circulation. Only time will tell whether the stimulus-aided jump in ecommerce spending is fueling the kind of economic activity that — along with other aspects of the American Rescue Plan — will carry the U.S. economy through until we reach a post-pandemic state of normalcy.

Photo by Getty Images

Finding scaling in the new era of ecommerce a challenge? We can help.