The latest data from Signifyd’s Ecommerce Pulse Report shows that wild gyrations in shopping patterns are continuing as much of the world shelters at home in order to slow the spread of the novel coronavirus.

The numbers, derived from the Signifyd Commerce Network, tell a story of winners and losers. Categories that had seen sharp increases as the pandemic was announced came back to earth last week and then some. And categories that had been sluggish began to perk up.

The latest statistics, covering March 23 to 30, tell the story of consumers who might be taking a deep breath as shelter-at-home orders and guidelines are extended and a new rhythm of life emerges.

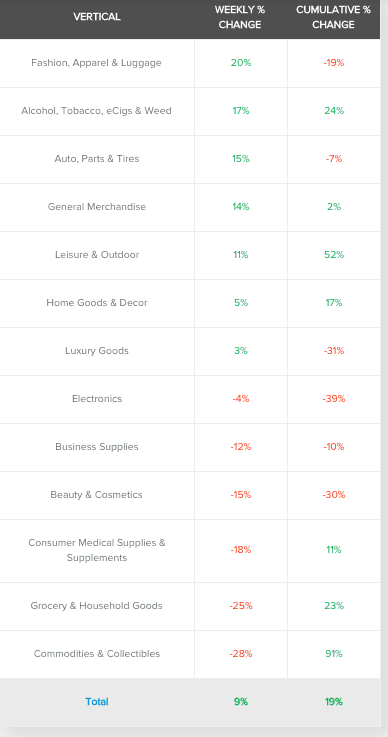

- Online sales continue to grow in the COVID-19 era overall — up 9% last week — with wide variability in merchant’s experience.

- The data shows signs that consumers are settling in for the long-haul.

- Shoppers are buying items to keep themselves distracted and entertained. Weed anyone?

- Ecommerce Pulse data is derived from Signifyd’s Commerce Network, a global sample of thousands of merchants.

Consumers are still increasing their online purchases, with many brick-and-mortar stores closed or offering curbside pickup. Overall, ecommerce sales were up 9% week-over-week. But what consumers were buying online the week of March 23 continued to shift.

Many may feel they have covered their bases with the essentials and are moving on to tend to some of the purchases they would typically make in the pre-COVID-19 era.

Grocery and household goods sales were down 25%. Commodities and collectibles fell 28%, after weeks in which consumers sought a safe haven in gold, other precious metals and collectibles that will retain their value as financial instruments and currency face downward pressure.

Big sellers return to pre-coronavirus sales levels

Medical supplies and supplements dropped 18% week over week. Beauty and cosmetics pulled back 15%, continuing to yo-yo, having been up 9% the week of March 17, following declines the first two weeks of the month. Sales of baby products and pet supplies were both down 30%-plus, after seeing dramatic increases the week the World Health Organization declared COVID-19 a pandemic.

In fact, the baby and pet categories ups and downs tell a very human tale.

“A lot of people bought, as soon as they could on that week of March 9, as many of those baby products as they might need for the foreseeable future,” Signifyd Vice President, Operations and Corporate Development J. Bennett, said in a virtual meeting with Signifyd’s Customer Advisory Board. “Once you take care of the baby, then you take care of the pets.”

The week after baby goods and pet supplies sales peaked, it was the home goods and decor category’s turn — up 15% for the week ending on March 23.

“Once you take care of the baby and the home and the pets,” Bennett continued, “then you take care of things to distract you. Toys and games have gone up. Video games have gone way up.”

The leisure and outdoor category, which includes games, saw sales increase 11% for the week. Other surging categories include auto parts and tires, and fashion, apparel and luggage. Another category that falls into the distraction bucket saw its best week of the COVID-19 era. Sales of alcohol, tobacco, e-cigarettes and weed were up 17% week over week. Enough said.

Are some ecommerce sales categories slowing because of a lack of supply?

And while the movement in the broad categories paints a helpful picture of how consumers and retailers are doing as they cope with the coronavirus, the numbers alone don’t always tell the entire story.

For instance Signifyd analysts are still working to determine how much, if any, of the sales slowdown in certain categories had to do with high-demand items being out of stock.

Moreover, Bennett told Customer Advisory Board members from brands such as Samsung, Mango, Stance and Crown & Caliber that only time would tell if the sales increases in certain categories were simply a function of consumers buying what they would buy anyway — just sooner than they might ordinarily purchase the items. Such a phenomenon could lead to a consumer pull-back later in the year that would translate into declining sales.

And, he explained, that even as online sales increase, some retailers are facing challenges in fulfilling orders. But they are adjusting.

In some ways it is still early days in the COVID-19 era. Consumers and retailers alike are still learning and still adjusting to new ways of buying and selling. We will continue to watch the numbers and the industry.

And we will continue to be here to tell you how, all of us together, are progressing.

Photo by Getty Images

The COVID-19 crisis is changing the face of business day-by-day, hour-by-hour. Read our weekly report, including data on changing industry trends in the time of Coronavirus.