Increase bank authorization rates and unlock more revenue

Signifyd’s Authorization Rate Optimization solution (ARO) filters out fraud and enables legitimate transactions with intelligence from our global Commerce Network, helping issuing banks confidently approve more orders, protect good customers, and accelerate ecommerce growth.

authorizations

false declines

Improve authorization rates with trusted intelligence

- Enhance issuer confidence and increase approval rates by assessing fraud risk first.

- Send cleaner, verified traffic to issuing banks for faster, more accurate decisions.

Recover lost revenue by reducing false declines

- Leverage our global Commerce Network to help issuing banks confidently approve legitimate transactions.

- Minimize false declines, improve conversion rates and boost revenue.

Protect customer trust with every transaction

- Deliver seamless checkout experiences that build loyalty and reduce churn.

- Ensure legitimate transactions are recognized and approved.

How authorization rate optimization works

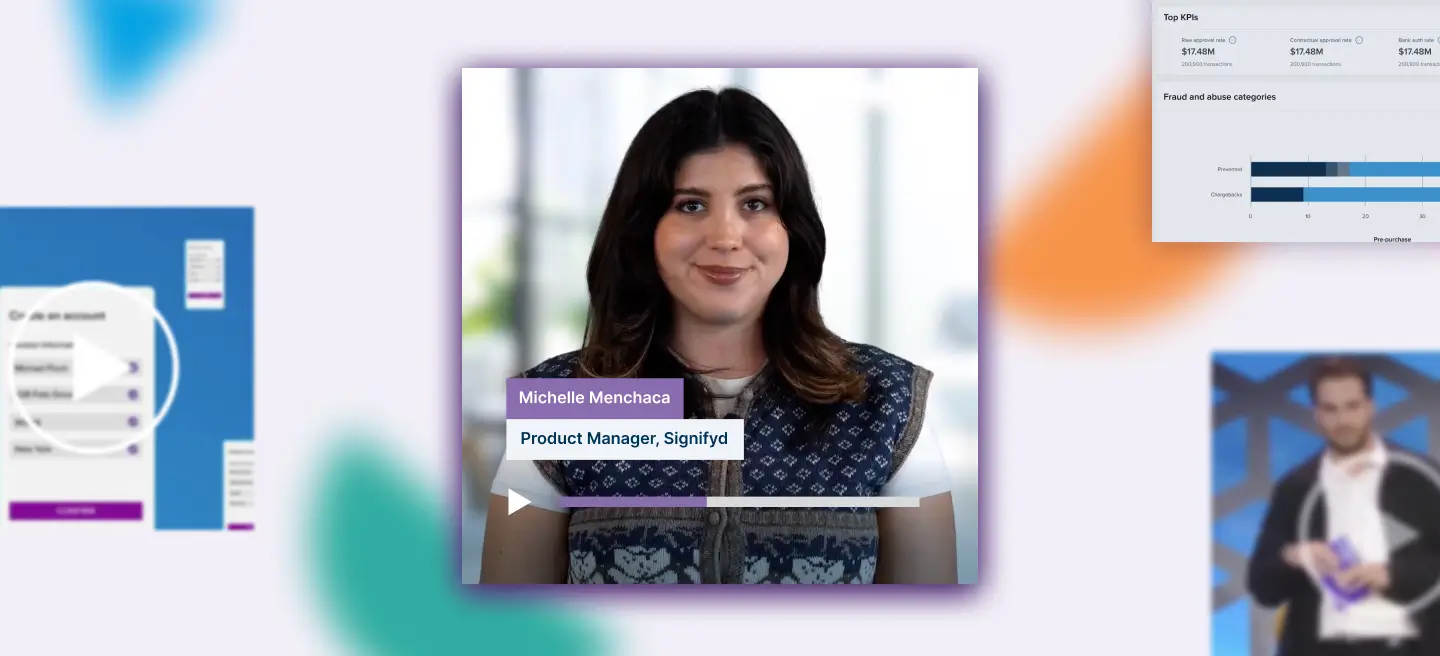

See authorization rate optimization in action

Discover how leading merchants are increasing approval rates and revenue with Signifyd’s pre-authorization fraud detection and prevention. Watch the demo to see how real-time intelligence empowers issuing banks to approve more legitimate transactions, reduce false declines, and unlock friction-free growth.

Discover the benefits of ARO solutions

Avoid missed revenue opportunities

Authorization Rate Optimization helps you recover lost revenue by identifying trustworthy transactions before they are sent for bank approval. Deliver a seamless buying experience that keeps genuine customers coming back, without adding risk.

Reduce transaction processing costs

Stop paying for fraudulent transactions that never should’ve reached the bank. Our ARO solution filters out high-risk orders at checkout, cutting unnecessary processing fees and reducing operational overhead, so more of your revenue stays where it belongs.

Eliminate costly network penalties

Too many fraudulent chargebacks can trigger payment network penalties that cost thousands each month. With Signifyd's fraud prevention built into the bank authorization flow, you maintain compliance and safeguard your margins.

Prevent poor customer experiences

On average, 30% of consumers don't return to a merchant's online storefront after being falsely declined. ARO helps ensure legitimate transactions are consistently approved and never turned away in error. Deliver the frictionless experience shoppers expect, building trust, loyalty, and lifetime value.

Trusted by leading ecommerce merchants

Join the global network of merchants and issuers working together to eliminate false declines

Signifyd is highly flexible and adaptable to your existing technology stack and leading financial institutions.

Extend ecommerce protection and growth with Signifyd

Your fraud protection needs are just the beginning. Signifyd’s related solutions help you recover lost revenue, strengthen customer relationships, and create new opportunities for growth across the entire commerce journey.

Guaranteed Fraud Protection

Leverage insights from the world's largest merchant network to prevent fraud in real time, confidently approve transactions, and ensure fraud protection with Signifyd's Guaranteed Fraud Protection model.

Account Protection

Block fraudsters while streamlining the experience for legitimate customers, reduce friction at login, protect brand integrity and eliminate ATO losses with a 100% financial guarantee.

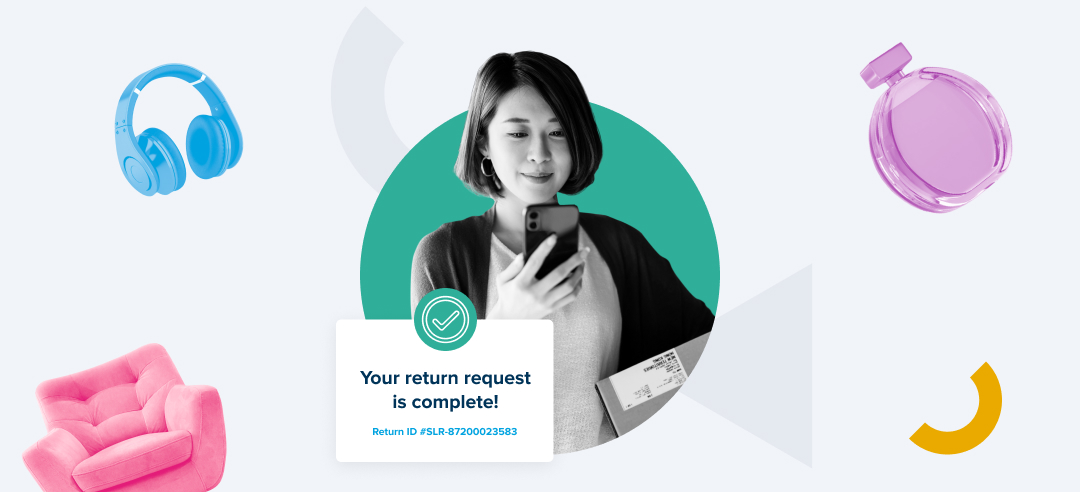

Return Insights

Turn return data into actionable intelligence with SKU-level and customer-segment insights that prevent fraud, return abuse and protect margins.

Ready to unlock ecommerce growth with ARO?

Schedule a demo with us and discover how our Authorization Rate Optimization solution helps ecommerce merchants approve more legitimate transactions and deliver the best experience for valued customers while driving revenue and business growth.