Overall ecommerce spending in Europe dipped slightly in the week just ended as brick-and-mortar stores continue to draw customers and consumers’ thoughts likely begin to shift from summer holidays to a return to school and some sort of routine.

Online spending was down 6% week-over-week for the seven-day period ending August 16, Signifyd’s Ecommerce Pulse data shows, but ecommerce receipts remained considerably higher than they were in pre-pandemic time.

One of the key economic storylines of the pandemic has been consumers’ embrace of online shopping and that was reflected in the fact that online spending remained 23% higher in the week just ended than it was in early March.

The week was marked by a pause in sales in two verticals that had performed incredibly well during the pandemic — Auto, Parts & Tires and Home Goods & Decor. The home goods category was down 21% for the week, while the automotive category fell 16%.

As an indication of what kind of pandemic run those categories have been having, consider that online spending in the automotive vertical remained 146% higher last week than it was before the pandemic hit. Home goods remained up 124%, as the lockdown focused consumers’ attention on improvements they could make around the house.

Leisure & Outdoor had been another strong performer during lockdown as consumers purchased exercise equipment and diversions to keep them occupied as the days and weeks dragged on. The vertical also saw a slowdown in the week ending August 16, with sales falling 10% week over week. Nonetheless, sales in the category were still up 26% over pre-pandemic figures.

On the positive side of the ledger, Business Supplies were up 18%, perhaps owing to more people going back to offices and with schools underway in parts of Europe and preparing to start in others.

While we have seen during the pandemic that online sales vs. sales in physical stores is not a zero-sum game, it will be interesting to watch in the coming weeks to watch for changes in growth in the two channels.

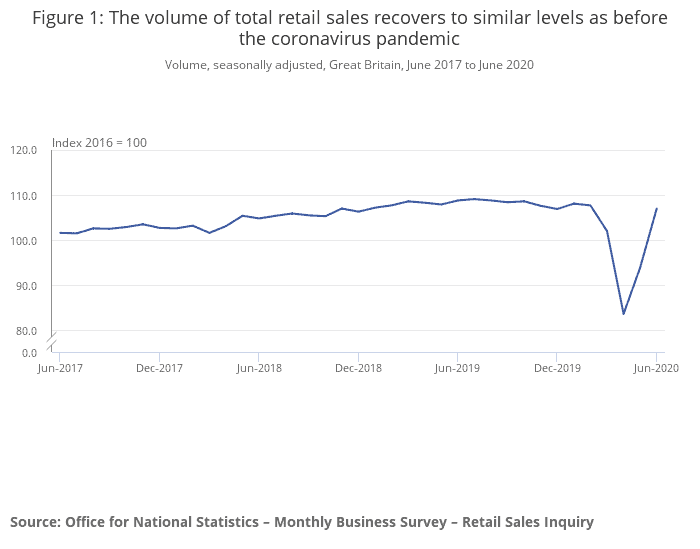

In the UK, which has seen positive retail sales reports this summer, the Office for National Statistics will release July retail sales figures later this week. The region saw notable gains in May and June, to the point where overall retail sales in June had nearly returned to where they were before the pandemic.