The headline number from the U.S. Commerce Department’s November retail sales report was the 1.1% drop in spending from October to November.

Analysts and reporters were right to focus on the number. Apparent weakness in the key month of the holiday shopping season is both newsworthy and important to the industry as a whole.

And, of course, it is almost certain that a dramatic spike in coronavirus cases, an increase in related lockdowns and the continuation of months of recession all played a role. Again, newsworthy and important stuff.

- Retail sales were down month over month in November, but up more than 4% year over year.

- Ecommerce has grown to 16% of retail sales, according to the Commerce Department’s latest figures.

- Online retail is experiencing unprecedented growth despite a struggling economy.

- Buying online and picking up in or at the store is seeing massive growth.

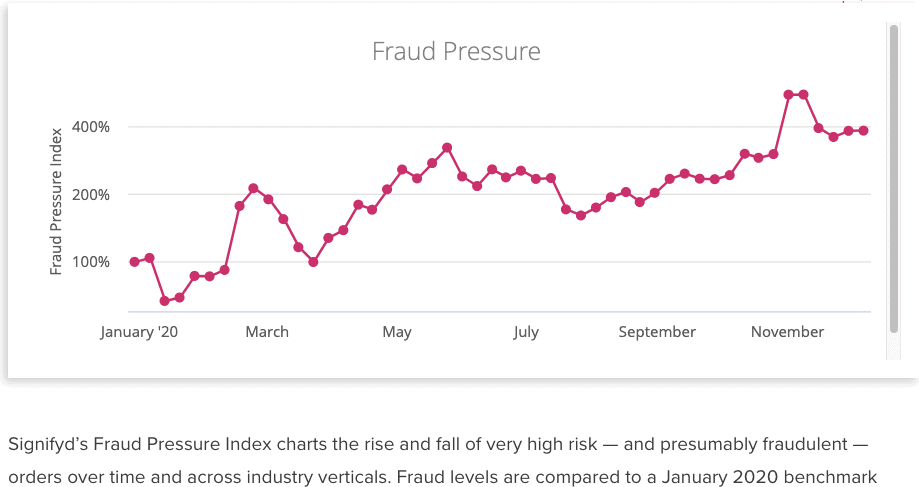

- Fraud pressure is rising.

But there were other numbers that painted a less dire picture. For one, while retail spending was down from October, it was actually up 4.1% from November 2019, the height of the holiday season in pre-pandemic times.

Ecommerce sales were up 52% in November year over year

And ecommerce, which has been a go-to for consumers throughout the pandemic, was up more than 29% year over year by the Commerce Department’s count and up even higher, according to Signifyd’s Ecommerce Pulse data.

U.S. online sales on Signifyd’s Commerce Network increased 52% year over year compared to November a year ago. And a number of retail verticals saw much larger increases, with Electronics, up 110%, Grocery & Household Goods up 97% and Home Goods & Decor, up 92%.

Moreover, while ecommerce remains a smaller share of commerce spending than physical retail, it is growing faster than at any time in history. Ecommerce — 16% of retail spend in November, the Commerce Department says — will see 32.4% growth in 2020, according to eMarketer. Meantime, brick-and-mortar retail is shrinking.

Other commerce numbers of note:

- Buy online pick up in store or at the curb was up 443% in the first week of December, compared to pre-pandemic January.

- Online sales remained strong into December, with ecommerce revenue up 43% last week compared to the same week a year earlier.

- Fraud pressure remained strong, with Signifyd’s Fraud Pressure Index up 283% compared to the first of the year. The fraud index tracks the rise and fall in the number of very high-risk orders as assessed by Signifyd’s Commerce Protection Platform.

- Consumer abuse — such as falsely claiming that an online order never arrived — declined in November. Signifyd’s Consumer Abuse Index fell by 69 percentage points from October.

Photo by Getty Images

Data by Signifyd’s Business Intelligence Team

We can help with your shift to a bigger ecommerce business.