- Ecommerce sales for the five-day period stretching from Thanksgiving through Cyber Monday 2020 were up 30% year over year.

- While Thanksgiving, Black Friday and Cyber Monday were revenue rock stars, the days in between performed even better — a sign of pandemic times.

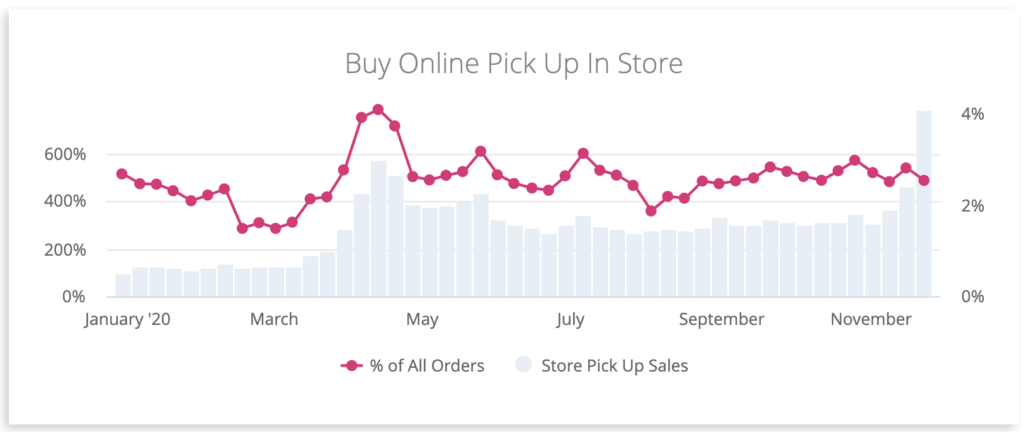

- Sales from online orders picked up in the store or at the curbside during the week of Black Friday were up nearly seven-fold from pre-pandemic numbers in January.

Cyber Week 2020 offered powerful confirmation that the coronavirus pandemic has transformed commerce and accelerated changes that have been in the works for years.

Same-store online sales were up 30% for the period, which stretched from Thanksgiving through Cyber Monday, data from Signifyd’s Commerce Network showed. Thanksgiving, Black Friday and Cyber Monday all set ecommerce sales records, according to CNBC, with Cyber Monday becoming the biggest online shopping day in U.S. history.

The digital spending spree contributed to year-over-year increases for November, according to Signifyd data, in both the United States and Europe. Sales for the month were up 52% and 54% respectively in those geographies.

“The same-store sales increases during Cyber Week were strong, as we expected,” said Pranav Gandhi, Signifyd head of business & strategy analytics. “But in some ways the picture was even brighter. We’ve added a number of enterprise merchants as customers in the last year. If you add those brands into the mix, ecommerce sales on our Commerce Network were up 74% for the long holiday kickoff weekend.”

While it seems that every year we’re talking about a record-breaking Cyber Week, known as the Cyber Five in some circles, the strong showing in 2020 is remarkable given all that is swirling around this holiday shopping season. Many households remain financially stretched in the midst of business shutdowns and job losses.

Black Friday and Cyber Monday shine despite financial worries

Consumers in the UK and the U.S. have said both that they’ve lost income due to the pandemic and that they fear losing income in the coming year, according to Signifyd consumer sentiment polls in both countries.

Counter-balancing those worries for ecommerce merchants is the dramatic shift to online shopping that accompanied retail shutdowns and consumer concerns about mingling with crowds inside brick-and-mortar stores. And so, online shopping it was.

Online sales on Thanksgiving increased 27% over Thanksgiving 2019, Signifyd data shows. Black Friday sales were up 31% and Cyber Monday saw a 20% boost. And while that Cyber Week up-and-to-the-right pattern has been a familiar one in recent years, there were new patterns evident in the data, too.

As impressively as the Big Three holiday shopping days did in 2020, the unheralded days in-between Black Friday and Cyber Monday did even better. Ecommerce sales on Saturday were 39% higher than on the Saturday after Thanksgiving last year. And Sunday posted a 38% improvement over a year ago.

While it’s true that those Saturday and Sunday increases come off a smaller base than the monster shopping days that surround them, they are another sign of the times. Consumers are spreading their spending out this holiday season. While the marquee days still rack up big sales, the 2020 increases in some cases were not as large as some analysts anticipated.

Consider that Adobe initially predicted Cyber Monday sales would reach $12.7 billion. On Tuesday Adobe reported the actual figure was $10.8 billion. That’s not to say that the nearly $2 billion difference didn’t get spent. It just didn’t get spent on Cyber Monday.

BOPIS and curbside pick up are off the hook

Another trend of note that has been spurred by consumers’ elevated enthusiasm for ecommerce and new-found fear of shopping in stores is a stunning increase in buy online pick up in store and pick up at curbside orders.

So-called BOPIS and BOPAC sales have been rocketing up since the pandemic became a way of life. But during the week of and leading up to Black Friday, buy online pick up curbside or in the store were up 682% over pre-pandemic levels in January, according to Signifyd’s Ecommerce Pulse data. It’s a service that consumers have told us in surveys they will be using well after the pandemic passes. Seems about right, given the numbers.

At the risk of spoiling the surprise of what might be coming your way this holiday season, let’s dig in to how consumers spent their money over the Cyber Week period.

Sales of Collectibles, a vertical that includes precious metals, were up 174% over Cyber Week a year ago. Alcohol, Tobacco & Cannabis saw sales double this Thanksgiving weekend over the Thanksgiving weekend last year. Home Goods & Decor sales were up 86%, likely a combination of holiday shopping and shopping by consumers who have been stuck in their increasingly familiar-looking homes for months on end.

Grocery remains strong as stockpiling appears to continue

Likewise, the boost to Grocery & Household Goods, where sales were up 54%, likely had more to do with pandemic-inspired shopping habits than holiday meal planning. Besides, the fact that consumers feel safer having groceries delivered than they do shopping in supermarkets, we’ve noticed a recent trend toward stockpiling as coronavirus cases rise.

Perhaps more in the gift-giving sweet spot were the increased sales in the Electronics and the Fashion, Apparel & Luggage verticals which saw boosts of 37% and 38% respectively.

And while Cyber Week was a shining success for most verticals, retailers selling Luxury Goods and Beauty & Cosmetics would be forgiven for viewing the five-day stretch warily. Luxury Goods sales advanced 2% over the period a year ago and Beauty & Cosmetics sales were down 10% year over year.

But as we noted earlier, Cyber Week might not be the make-or-break shopping period it was in the pre-coronavirus days. And trying to predict what will happen in the rest of 2020 based on what’s already happened in 2020 is a fool’s errand.

Photo by Getty Images

Data provided by Signifyd Business Intelligence Team

We can help with your holiday order spikes and with your buy online pick up in store acceleration.