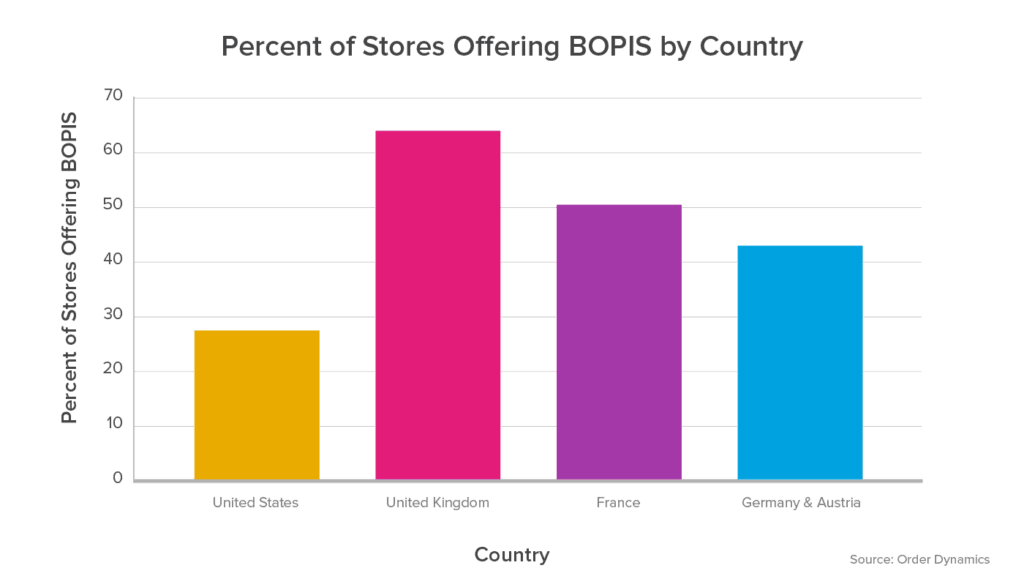

Retailers almost universally talk about how important click-and-collect is to building a comprehensive omnichannel experience. The actual embrace of providing customers with the option, however, varies widely depending on where in the world a retailer is.

An in-depth study by order-management company Order Dynamics finds that European retailers, and retailers in the UK particularly, are killing it with click-and-collect when compared to their U.S. counterparts. Order Dynamics found that 27.5% of U.S. retailers offered consumers an option to buy online and pick up their orders in a store, well below the global average of 37.6% that order dynamic came up with by studying seven countries.

The U.S. and global figures are anemic compared to those from European countries, which appear to have firmly embraced the flexibility — and increased revenue potential — that click and collect offers.

In the UK, for instance, 64% of retailers offer a click-and-collect option, according to Order Dynamics. Half of French retailers offer the option and 43% of the retailers in Germany and Austria combined allow consumers to buy online and pick up in store.

And while the gap between the U.S. and Europe is stark, it is not necessarily that surprising given the evolution of ecommerce on the opposite sides of the Atlantic.

Consider, for instance, that eMarketer projects that 22% of retail sales in the UK this year will be attributable to ecommerce. In the U.S., eMarketer says, the figure will be less than half that — 10.7%.

The split may be indicative of what has been a self-fulfilling prophecy. Retail strategist Carl Boutet says that it makes sense that BOPIS would be more popular in Europe than in the U.S. because Europe is more densely populated overall. The continent also has a strong tradition of excellent retail logistics, which has likely opened the eyes of Europeans to the range of possibilities when it comes to the simple act of shopping.

No doubt, countries like Great Britain have taken to ecommerce more enthusiastically than the United States. That’s been evident for years. Bill Fisher, an eMarketer analyst in Great Britain, explained to me in 2014, that England, for instance, is well suited for digital commerce and click-and-collect in particular.

The relatively compact geography of the place, he said, meant that orders could more easily arrive overnight, even before one-day delivery became such a high expectation. Beyond that, ordering on mobile and click-and-collect was much more a part of life in the UK than in the U.S.

Boutet agreed.

“It could also be cultural, where people are more used to picking up goods on the way home from work,” he told me via Twitter direct message. “Especially on high streets vs. going to a mall or ‘power center.’”

Click-and-collect has a headstart in the UK

Indeed, retailers for years have been offering London commuters the chance to order online and pick up at fulfillment lockers at underground stations.

eMarketer’s Fisher explained that he personally understood the appeal of ordering online and picking up in store, or a central location — something he was doing regularly when it came to grocery shopping.

“I can order something online and I have something like six collection options, three of which are less than a five-minute walk from my house,’’ he said at the time.

The geographic breakdown of click-and-collect availability goes well beyond bragging rights. Click-and-collect or BOPIS (buy online pick up in store) is seen as an important piece of the omnichannel puzzle. Consumers are coming to expect it and forward-thinking retailers are coming to realize that the service is a way to optimize revenue.

Enterprise Retailers Weigh Risks and Rewards of BOPIS

In a Signifyd survey of 250 retail professionals, 44% of those providing BOPIS said the service was necessary to keep up with the competition or to gain an edge on Amazon. Nearly 38% said the option was a way to draw more customers into the store, where, presumably, they would buy items in addition to the items they had come to pick up.

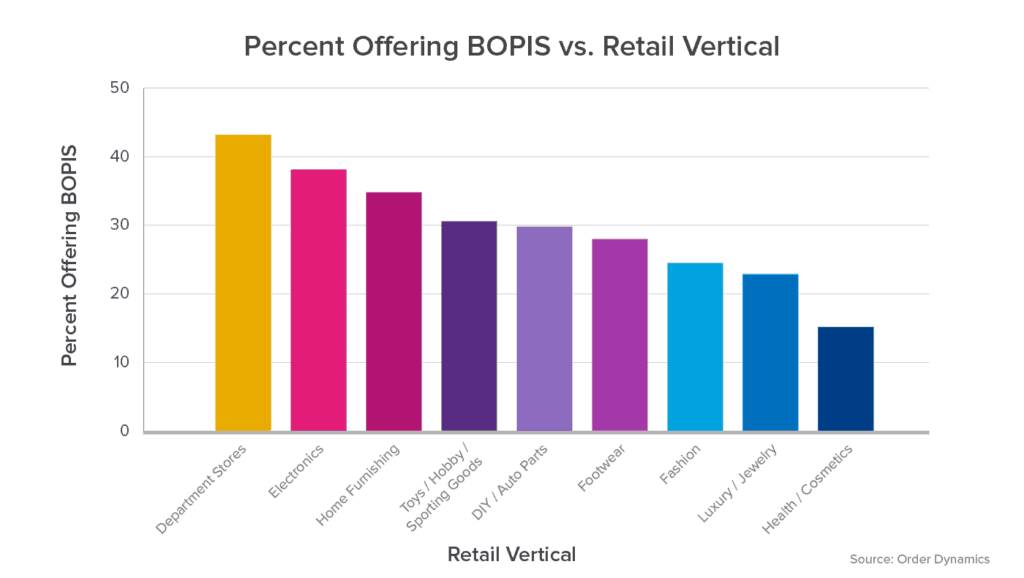

It seems highly likely, both from the survey results and from the example set by European countries, that the availability of click-and-collect in the U.S. will grow. A quick look at how various retail verticals have embraced picking up online orders in the store paints a picture of a trend in its early stages of maturing.

Certain sectors, like department stores and electronics, appear well on their way to establishing click-and-collect growth as a given. But other sectors, notably health and cosmetics and jewelry appear to be still contemplating the risk and reward involved in offering the service.

No question there are challenges that come with the territory, which could be giving some retailers and some retail sectors pause. Signfiyd’s survey, which was conducted by polling company Survata, found that retailers were challenged by the need for precision inventory tracking and the ability to move inventory around to serve BOPIS ecommerce customers.

They also cited the need to specially train staff as a challenge and reported that they were worried about the return on investment. And they raised fraud concerns, given that BOPIS would involve online orders that would need to be filled quickly, rushing fraud reviews, and that the orders would come with no delivery address — a key bit of data that helps confirm a shopper’s identity.

Look to third-party experts to help with BOPIS

The issues, while seemingly daunting, can all be managed by companies specializing in providing BOPIS services. Signifyd, for instance, offers an AI-based fraud protection solution that uses big data to sort legitimate orders from fraudulent ones in milliseconds. Signifyd also provides a 100% financial guarantee, which means retailers don’t have to worry about fraud as they fill their BOPIS orders because Signifyd will make them financially whole on any approved orders that turn out to be fraudulent.

Despite uncertainty among retailers about click-and-collect today (After all, half or more of retailers in most of the surveyed countries have yet to launch the service.), one thing seems certain.

Just as ecommerce continues to grow as a retail channel, click-and-collect will continue to grow as a channel to deliver ecommerce experiences. Consumers have made it clear they want it. And the market is making it clear that retailers need it.

Photo by Henrik Dønnestad on Unsplash