In our first post we discussed what online payment chargeback are, and what the chargeback process looks like. In the second post we discussed the legality of a chargeback and what to look for in chargebacks. Now we are getting to the sweet spot for merchants, how to avoid chargebacks as well as those pesky chargeback fees!

Do merchants get banned for too many chargebacks?

For consumer protection, every card issuer has their own chargeback automation monitoring program. These are the links for the Visa chargeback program as well as the link for MasterCard’s. For a comparison of the two programs this pdf helps to show the differences between the two .

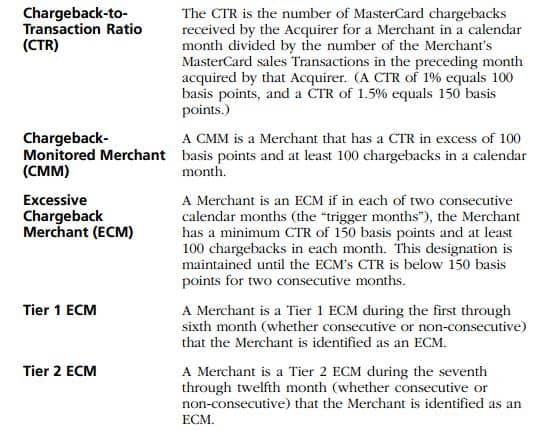

The answer though to the question above is an absolute yes. According to Chargebacks.com, 1% is a merchant industry maximum for card issuers when it comes to chargebacks. In a snippet from the attached MasterCard document, one can see how MasterCard tracks and defines its merchants applying different categories to them based upon the volume and the longevity of their chargebacks.

If a merchant stays above 1%, they will enter into the world of the above mentioned ecommerce chargeback protection monitoring programs..

If a merchant during this time either fails to bring their chargeback rate down or is unable to successfully dispute and win chargeback abuse against them a card issuer will terminate their relationship with a merchant.

Excessive dorm room prep shopping accounts for 35% of all chargebacks

Do merchants get hit with fee’s for multiple chargebacks?

The first time a merchant gets hit with a chargeback, the fee can vary depending on the credit card processor. PayPal charges $20, Stripe charges $15 and Google Checkout will charge $10.

According to chargefellow.com, the average credit card chargeback fee ranges between $5 to $15 dollars, and this fee is paid regardless if the merchant wins their chargeback dispute or not. The real pain comes if a merchant is placed in their chargeback monitoring program. $5,000 dollars is the fee for being inducted into this dubious club, with high levies based upon chargeback volume.

Do the banks ever side with the merchants?

Banks can side with merchants, but be prepared to work for your money. The burden of proof lies on the business, not on the consumer, to prove that they should keep their revenue. According to paymentsviews.com, the process of re-reversing a chargeback which is task known as a retrieval request only happens 10% to 15% of the time. This goes to show the uphill battle merchants face when battling the banks who themselves do not wish to lose any customers. The key to all of this is precise documentation of every order, which increases the likelihood of winning a dispute charge with a bank.

After one chargeback, can I block customers from future transactions?

The answer to this is yes, online retailers can block customers. In what is known as merchant deny lists, online retailers can add a customer’s name to an internal list to block future transactions listed by that individual. Many merchants prevent chargebacks by allowing only one chargeback per customer, and subsequently placing that customer on a deny list which bans them from shopping on their site. Many more merchants will ban a customer for life after a single chargeback. Some merchants go even further and will purchase industry deny lists of customers who have initiated a chargeback claim against another merchant to block that customer altogether from making a purchase.

How do I prevent chargebacks?

The answer is easy but can be time consuming without tools like Signifyd to help your company. Merchants need to screen every transaction to ensure that they are not about to process an order for a high risk customer. Previously, merchants would screen their questionable orders by manually calling up a customer to verify their identity and that they have the card in hand. This would go a long way in stopping a fraudulent transaction plus a chargeback. But there is only so much information a person can extract from a quick phone call. Signifyd can pull complete customer profiles for every order that passes through your system. This includes checking the email, phone number, billing and shipping addresses as well as their credit/debit card for any chargebacks the customer may have initiated in the past. With Signifyd’s complete order verification service, merchants worried about chargebacks can simply pass their orders into our system and instantly be advised as to whether they should accept or decline an order as well as an explanation behind that decision.