Welcome back for another post on fraud terminology. As we dive into post #3 in our series on the top 10 fraud phrases used in the industry we want to thank you for your increased readership. We were happy to find our first blog post on Velocity Checks mentioned in the Merchant Risk Council biweekly newsletter, so Signifyd would like to give a shout out to the MRC for linking to us. Our last post was on reverse IP address checks, and today we will be tackling Cross Merchant Linking.

#3 Cross Merchant Linking

What is Cross Merchant Linking?

If the company you work at has been hit by fraud, the first thing you must realize is your company does not exist in a vacuum. Fraudsters target multiple companies, and as such have left their digital fingerprints and criminal handiwork all over the web. When a chargeback fraud attack, friendly fraud, or another instance of financial loss occurs against a company, most merchants store that information in their database. Over time, companies cultivate what is commonly called allow lists and deny lists, essentially lists of information that contain trusted customers and the information of fraudsters who have attacked their system.

How can your company benefit from Cross Merchant Linking?

While competing companies would never share lists of their most trusted and valuable customers (the allow lists), the benefit of sharing the information about online criminals among other online retailers is obvious. The more information that is shared between businesses, the smaller the victim pool a fraudster has to choose from. Let’s examine this by considering a quick scenario.

Business A is a high end watch retailer and has twice been hit by online fraud in the same week. While the credit card and shipping address used in both fraud attacks were different, Business A notices that the fraudster had the exact same IP address. Business B is also a high end watch retailer, and a week after Business A suffers its two fraudulent attacks, Business B receives a large online order for multiple watches. Because both business use the same fraud provider (Signifyd), Business B will immediately be notified that this IP address is known to be associated with fraudulent purchases and to immediately decline this purchase. This information would only be available by the shared knowledge of Business A. Without having a cross merchant database, both companies would be more likely to fall victims to the same fraudster. But by sharing information, the whole business community benefits.

The rationale behind Cross Merchant Linking is exactly the same as a credit history. If the email, credit number, or any other piece of information entered into your checkout has a fraudulent history, it’s likely your business is about to get hit by fraud. If this is the first time that this email address has been used for a transaction that is also a major red flag.

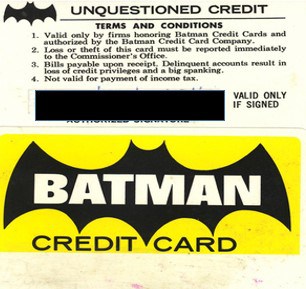

Batman knows if you check his purchase history, and we advise you against it.

I run a new business, how do I get access to Cross Merchant Records?

For an unsurprising answer and shameless plug of ourselves, companies like Signifyd are your best bet in this endeavor. Googling ‘deny lists’ or ‘fraud lists’ are going to land you closer to a fraud black market website than the information you’re seeking. That is because while companies want to stop fraudsters, letting the fraudsters know in online lists that fraud companies are aware of their identity and/or aware of their fraudulent methods will cause them to elude those very lists through new fraudulent activites. Through top fraud prevention companies like Signifyd, Cross Merchant Linking is a standard option available to all online merchants in our common goal to stop online theft.

Thanks for reading today’s post, and as always we appreciate your comments and questions so please reach out to us at [email protected] or at [email protected]! Stay safe out there in this digital frontier, and we will see you for our next blog post.