Black Friday has morphed into nearly a full week of shopping events planned around the Thanksgiving holiday. As records fall every year and people increase their spending in store and online, merchants can learn a lot from the economic frenzy. That’s why we put together this look back at the 2019 holiday shopping season kickoff, with some insight into how to help your customers win big for Christmas.

Record breaking numbers all weekend long

The numbers are in: Black Friday was a smashing success. The entire holiday weekend broke shopping records, with Black Friday bringing in $7.4 billion according to Adobe Analytics. Adobe also reported that online shoppers focused their buying frenzies on early morning deals and specials, topping out at $600 million spent by 9 a.m. Friday.

While Black Friday took over the holiday shopping spotlight, the rest of the weekend didn’t slow down. Thanksgiving Day shopping hit $4 billion in sales for the first time ever, rising 17% over 2018 numbers. Cyber Monday kept up the pace, with $9.2 billion in sales according to Adobe Analytics. During the peak shopping hours of Cyber Monday, which Adobe Analytics labels as between 8 p.m. and 9 p.m. PST, consumers spent an average of $11 million per minute.

Cyber Week 2019 broke sales records:

Even Small Business Saturday made a splash with online shoppers. An Inc. report citing the Adobe Analytics holiday spending metrics said that consumers spent $3.6 billion buying online from small businesses on Saturday: 18% more than in 2018. Small businesses are bringing in more revenue that ever from online sales. Adobe reports $68.2 billion in online sales from small retailers between Nov. 1 to Nov. 30.

The main factor driving this explosive shopping growth over the biggest retail weekend of the year wasn’t deep discounts or huge sales. Mobile devices drove customer engagement and allowed shoppers to show up in record numbers — without even leaving their homes to score great deals.

Mobile makes big money for merchants

Online shopping isn’t a new Cyber Week activity. But the increase in mobile shopping led revenue growth for the 2019 holiday shopping kickoff with mobile orders increasing 35% on Black Friday and 65% of all ecommerce orders coming from a mobile device, according to Salesforce.

Adobe called Black Friday “the biggest day ever for mobile,” tracking $2.9 billion in sales from smartphones alone, writes Retail Dive. That accounts for 39% of all ecommerce sales this holiday weekend.

Here’s how mobile made an impact over Cyber Week 2019:

- 33% of shoppers used their smartphones to shop on Cyber Monday, according to Adobe Analytics

- 65% of all Thanksgiving Day digital orders came through a smartphone

- 41.2% of all ecommerce revenue from Saturday shopping came from mobile devices

It’s also important to understand how consumers are finding their path to mobile shopping deals. In the United Kingdom, Black Friday peak browsing hits at 11 a.m., with peak buying hours stretching well into the evening from noon to 9 p.m.

Tech Crunch reported on which types of online advertising resonate with holiday shoppers:

- 24% of all purchases come from paid search

- 20% come from social media accounts, with influencers driving one in 10 Gen Z shoppers to buy products

- 9.4% come from email marketing

Mobile is a key strategy for retail growth. But it’s not the only play out there for merchants. Don’t ignore the importance of a solid omnichannel strategy — it’s how the biggest retailers came out on top this last week.

Customers want it all — on their terms

Mobile shopping attracted buyers so much because it allowed them to make the purchases they wanted on their time and on their terms. For Thanksgiving Day shoppers, that meant being able to buy while digesting a huge meal and not leaving their warm, cozy homes. But for others, shopping anywhere and any way they like includes everything from the omnichannel playbook, including the popular buy-online-pick-up-in-store (BOPIS) option.

The Washington Post reported that of the record 190 million shoppers who turned out over the Thanksgiving weekend, about 48 million consumers shopped only in stores, 66 million shopped only online and 76 million shopped both in stores and online.

Adobe Analytics found that BOPIS is a key driver of retail sales: 61% of online shoppers plan to take advantage of same-day shipping or BOPIS this year. This year to date, BOPIS services have generated 39.9% more in sales than last year, a trend Adobe researchers expect to continue as Christmas grows closer.

The retailers that can offer customer experience as a product alongside the items they sell find the most success in the new retail world. Forbes reported on how Walmart and Target won big over the traditional holiday shopping kickoff weekend, by basing their strategies on omnichannel shopping experiences, strong mobile shopping platforms and BOPIS options.

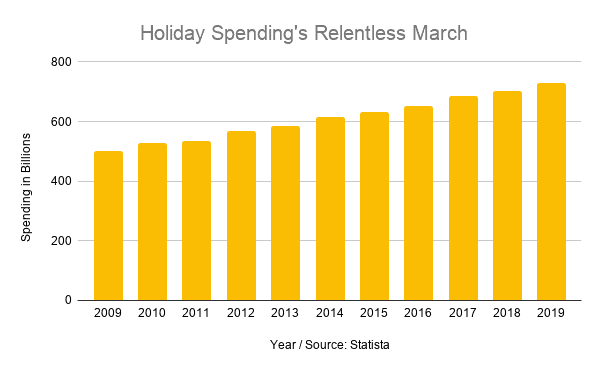

Cyber Week 2019 is over, but that doesn’t mean the retail action will die down. Black Friday is just the beginning. U.S. shoppers are expected to spend as much as $731 billion during the entire holiday season, according to the National Retail Federation. Consumers will part with about $143 billion of their holiday spending online, Adobe says.

So, there’s still a lot of shopping left to do — and for the first time in years, less time to get it all done.

Don’t sweat the shorter shopping season

Every Black Friday features news reports of people going overboard at stores to get the biggest deals and save the most money. The fights and madness aren’t worth it for most people. PwC reports that 49% of shoppers plan to shop after Black Friday week.

Although 2019 may not be the best year to wait a few days for good deals.

The Los Angeles Times reports that this holiday shopping season is six days shorter than in 2018. That puts the official holiday shopping season at just 26 days — the shortest since 2013, according to Bloomberg. The time crunch has retailers on edge, with less time to shop. “It’s a very compressed holiday season,” Target CEO Brian Cornell told Bloomberg. “Every day counts.”

Bloomberg dug up past ultra-short holiday shopping season tactics that have since become Black Friday staples, like:

- Old Navy and Best Buy opened on Thanksgiving Day rather than Black Friday, and Amazon partnered with USPS to offer Sunday delivery (2013)

- Online shopping was still relatively new so stores promoted their websites as ways to shop around the clock (2002)

- Walmart kept some locations open for 24 hours (1996)

A shorter season demands creative thinking from merchants. Fortunately, you can use the above insights to craft a winning strategy to carry your holiday sales all the way through to Christmas Eve.

The holidays are here. Let’s get to work

Retailers of any size and from any product category can learn from the record-breaking Cyber Week shopping activity. By prioritizing mobile strategies, omnichannel options and timely promotions with fast shipping, you can still be a customer’s hero when holiday shopping crunch time hits. Make this holiday season bright for your shoppers with great customer experiences, and watch the profits roll in.

photo by iStock Photo

At some point, online sales have to end. Shipping hits a threshold where the item just can’t arrive on time for Christmas. 2019’s shorter holiday season means there’s less time to make an impact in ecommerce sales. That’s why order automation is so important for retail success this time of year. Contact Signifyd to learn how we can help optimize your revenue stream.