With Black Friday and Cyber Monday just over a week away, signs of the dark side of holiday shopping are beginning to emerge along with a surge in ecommerce orders.

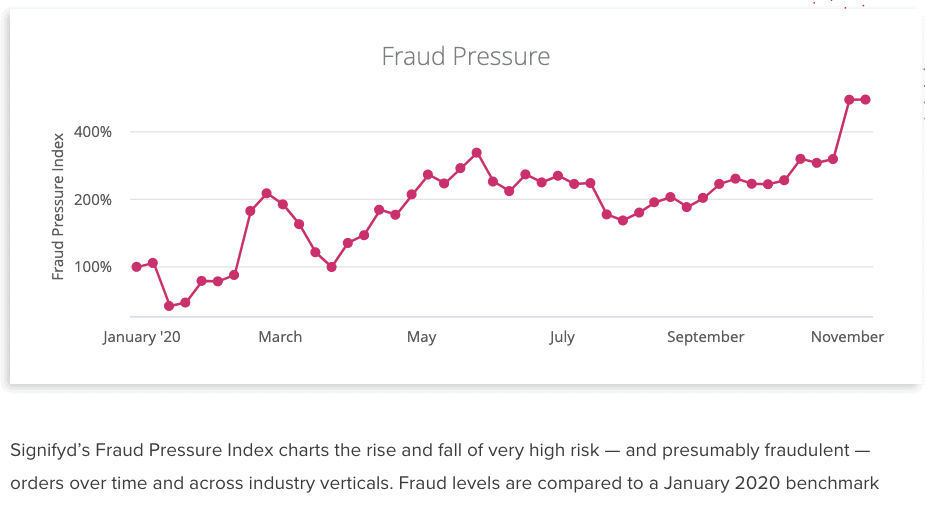

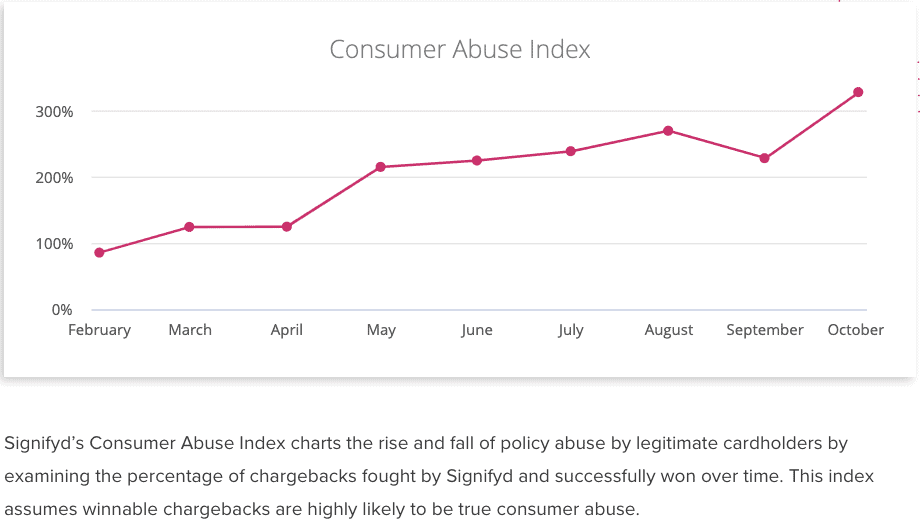

Both Signifyd’s Fraud Pressure and Consumer Abuse indexes have been moving dramatically up and to the right in recent weeks — creating something of a Grinch Index for holiday 2020.

The Fraud Pressure Index reached its highest point of the COVID-19 pandemic era last week, indicating an acceleration in activity by fraud rings in the run-up to the traditional kickoff of the busiest shopping season of the year for most retailers.

- Signifyd’s Fraud Pressure Index is up 450%, reaching its highest point in the COVID-19 era

- Signifyd’s Consumer Abuse Index has climbed 227% also a high since the pandemic was declared in March.

- Consumers are saying that they are more likely to try to game the ecommerce system than they have been in the past

- Several signs have created a Grinch Index that points to a holiday season that will require vigilance on the part of retailers and brands.

The fraud index has generally been on the rise throughout the pandemic. For two weeks now, the index has been up about 450% from its pre-pandemic benchmark. That’s after skyrocketing by 84% between the last week of October and the first week of November.

For its part, the Consumer Abuse Index is up 227% from its pre-pandemic benchmark — the highest the index has been since the pandemic was declared in March. The index is a measure of the number of false claims that online shoppers file to try to get refunds, often while keeping the product. The claims include complaints such as that the order never arrived or a subscription cancellation was never honored.

Friendly fraud and fraudulent activity spike is no way to start the holiday season

The trends are worrisome for retailers heading into a holiday season that will be like no other. Signifyd Head of Risk Operations Ping Li has warned about the disharmonic convergence of the pandemic and the holiday shopping season. Stress and work-from-home routines open consumers up to phishing attacks, which provide fraudsters with the credentials they need to steal accounts or make unauthorized credit purchases. Holiday order volumes, meantime, give fraudsters the cover they need to better avoid detection.

“I think COVID actually has a serious impact on the fraud landscape,” Li said at Signifyd’s recent FLOW Digital Risk Connect, citing the analyses of cybersecurity experts. “They have warned us that there are many more phishing attacks against online users. Many businesses have had to go online. And there are many new users who are not used to doing online shopping. They don’t have much online security experience.”

Online fraud and consumer abuse are problems year-round, but often become more challenging in the holiday season. It’s a time when ecommerce orders spike, the pace of retail is frenetic and consumer expectations are at their highest. This year, that’s all times two. Retailers have been managing holiday-high and near-holiday-high ecommerce sales volumes for months, as a result of the pandemic and a rapid shift to online commerce. The 2020 holiday surge will be a surge upon a surge.

Fraudsters look to take advantage of the sometimes chaotic conditions and the recent rise in fraud pressure could be a sign that fraud rings are testing and ramping up the machinery that makes their criminal enterprises go.

False INR claims tell the story of the COVID Christmas season

Consumer abuse has been an increasing challenge for online retailers in recent years. But the growth of false claims has been particularly robust since the pandemic became a worldwide health crisis in March. In fact, the index has risen in every full month of the pandemic, save for September, when it took a slight dip before heading back up.

Digging into one slice of consumer abuse — false item-not-received claims — paints a clear picture of how the problem has escalated. Chargeback item not received claims, known as INR claims, are often associated with the holiday season and porch piracy. This season, however, it appears more likely that the actual pirate is living inside the home where the package was delivered.

Here’s how it works: When a package that should have been delivered isn’t, a consumer can ask her or his credit card company for a refund which the card company recovers from the retailer. More and more, however, some consumers are seeking INR refunds even though they actually received the package they ordered.

In fact, by October, the number of false INR claims was up 67% over October 2019. Signifyd data shows the false claims began climbing as the 2019 holiday season got underway. It dropped post-holiday, as expected. But rather than remain low after the holiday rush, the number started heading skyward again as pandemic lockdowns began and ecommerce took off. It has risen slightly throughout the COVID-19 pandemic.

The rising consumer abuse numbers correlate with what consumers said in a recent poll commissioned by Signifyd and conducted by market researchers Upwave. Among the findings involving consumer abuse:

- More than 40% of survey respondents said they had falsely claimed that a legitimate charge on their credit card was fraudulent in order to receive a refund and keep the product they ordered.

- More than 33% said they had falsely claimed that an online order never arrived or that an order that did arrive was not as promised, in order to keep the order and get a refund.

- More than 30% said they had broken discount or promotion rules, such as using a one-time offer more than once.

How to get a handle on the dark side of ecommerce

The numbers are notable on their own. But at least one statistic takes on added significance when you compare it to the response to a different, but similar, question Signifyd asked consumers in January. In that pre-pandemic poll, only 8.1% of consumers said they had falsely claimed that a package that did arrive had never arrived.

Given the increase in fraud pressure and consumer abuse heading into the thick of the holiday season, retailers should increase their vigilance. Analyzing fraud procedures and tools and preparing to scale up for order surges is at the top of many retailers’ lists — if it hasn’t been checked off already.

Signifyd customers have turned to the Commerce Protection Platform to turn away both fraudulent and abusive orders. The platform uses big data and machine learning to instantly sort fraudulent orders from legitimate ones. Its Abuse Prevention solution uses the technology to spot abusive orders and automate chargeback management. And the platform’s decisions come with a financial guarantee, all of which allows infinite scaling without the worry of being overwhelmed by holiday orders.

Photo by Getty Images

Data provided by Signifyd Business Intelligence team

The Fraud Pressure Index measures the rise and fall of orders on Signifyd’s Commerce Network that are determined to be a very high risk of fraud, based on thousands of signals. The Consumer Abuse Index is a measure of questionable chargebacks disputed and won by Signifyd.