Retailers have fully settled into the post-pandemic order of ecommerce.

Online commerce is a bigger part of retail than ever before and its size and growth make it more important than ever before, too.

The early 2020s brought a wave of new ecommerce customers and drove sales to dizzying heights. It changed forever the role of ecommerce in consumers’ lives and left online brands with an unprecedented opportunity.

Of course, the stretch of all-but-assured growth is past, so taking advantage of that unprecedented opportunity means retailers need to be thoughtful, resourceful and future-focused. Successful brands need to build profitable growth through a focus on customer lifetime value.

To get there some may need to lean harder on strategies and tactics they might have previously undervalued. Things like building trust, expanding personalization beyond marketing and embracing liability shift as a way to approve more orders without increasing the risk associated with fraud.

Shift matters: How liability shift increases profitability

With the rapid growth of the early 2020s in the rearview mirror, online merchants need to adapt to a world of decent, but slower, growth. Think 10% year-over-year rather than 30% year-over-year. That means that missing out on sales from good customers is no longer an option — it is more important than ever that retailers optimize the orders they do get.

And that of course includes the step of accepting more orders in the first place and avoiding first-party fraud chargebacks in the second place. After all, chargebacks liability extends beyond checkout to false item-not-received and product significantly-not-as-described claims.

So how can retailers go about doing this? Depending on their tech stack, it’s very possible retailers already have tools at their disposal to enable this — at least in part. Consider, for instance, your payment and fraud-prevention tools.

Each step of the payment process has the potential to inadvertently screen out good orders. Checkout, payments and even ecommerce platforms sometimes include rules that can block geographies or disrupt orders with apparent CVV or AVS irregularities.

And of course, the tricky balance of customer experience and protecting the business isn’t confined to checkout. A liability shift for payment fraud is a load off — but maybe only half a load in an era when friendly fraud, or first-party fraud, is growing faster than payments fraud.

Signifyd goes beyond what most in the new class of guarantee providers offer. Yes, Signifyd’s Commerce Protection Platform provides guaranteed fraud protection at checkout. But it also offers Complete Chargeback Protection, which provides a financial guarantee on all manner of chargebacks, including item not received (INR) and significantly not as described (SNAD) claims.

In other words, Complete Chargeback Protection brings liability shift to a whole new level while also maximizing conversions and eliminating additional risk for merchants.

Fraud protection that does not shift liability kills conversions

Traditional fraud prevention tools come with static rules that produce false positives, meaning good orders are not shipped to legitimate customers. They depend on logic that reinforces mistakes that label good orders as fraudulent. As a result, from 2% to 10% of the orders ecommerce retailers reject for fraud are actually good orders, according to the Merchant Risk Council.

The fraud prevention flaws stem from thinking of enterprise fraud management as a way to throttle out bad orders. Liability shift comes with a mind shift: What about flipping the notion of throttling bad orders on its head and turning to a newer breed of fraud models — models that shift liability and combine big data, machine learning and domain expertise to assess orders and look for every possible reason to accept an order?

It makes sense, given that refusing legitimate orders from honest customers is a bigger problem than incorrectly sending products to fraudsters posing as honest customers. In fact, 451 Research determined that online brands unnecessarily turn away $16 billion in orders a year for fear of fraud when there is none to be feared.

And by the way, consumers don’t like being turned away when they are willing to spend money with a merchant. In fact, 36% of U.S. online shoppers surveyed on behalf of Signifyd said that they stopped patronizing a merchant after having an order declined for no apparent reason — a typical false-decline scenario.

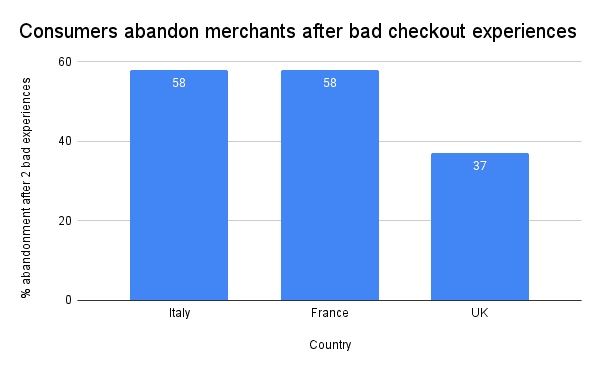

The level of tolerance for bad online experiences was similar in the UK, where 37% of online consumers surveyed on behalf of Signifyd said they’d leave a retailer for good after one or two bad experiences. In France and Italy, shoppers were even more impatient, with 58% in each country saying they would stop shopping with an online merchant after one or two bad experiences. Can we stipulate that having a legitimate order turned down for fear of fraud qualifies as a bad experience?

What does successful liability shift mean?

So it is time for retailers to use the fraud tools at their disposal but in a new light — to approve more orders, not just squash fraud.

And this doesn’t need to be at the risk of increased chargebacks and greater fraud pressure. Retailers can, in fact, accept these additional orders and shift liability away from themselves. This is where liability shift solutions such as guaranteed fraud protection and 3-D Secure come into play.

Both approaches work in different ways, but achieve the same goal of shifting the financial liability away from the retailer.

Many are familiar with 3-D Secure. It’s widely used in Europe where it helps satisfy the requirements of Strong Customer Authentication (SCA). 3-D Secure is currently being more widely talked about in the U.S., where only about 3% of orders are subject to the process, according to Datos Research.

The 3DS process can trigger a step-up task for consumers at checkout, during which the consumer is challenged to re-enter details from their card/bank account, answer a challenge-and-response-type question or show biometric proof of identity.

If the response is successful, the transaction is approved and the liability is shifted from the retailer to the card issuer. The problem is that though 3DS has been much improved, it still can be a poor customer experience, interrupting the flow and causing friction during checkout.

3DS liability shift has not always been smooth

In the UK, where 3DS is in wide use, 36% of surveyed consumers said they couldn’t complete a transaction because of 3DS-powered SCA. In the U.S., 3DS orders can become a red flag for certain issuers who equate 3DS-reviewed orders with risky orders. That’s because merchants using 3DS in the U.S. tend to shift their riskiest orders to the 3DS rails. The thinking goes: As the merchant I don’t want to risk shipping it. So, why not see if it can clear the 3DS step-up? The worst that can happen is the order is declined.

If the order clears the step-up the merchant gets the conversion. Even if the order turns out to be fraudulent after clearing the step-up, the order is covered by the 3DS liability shift and the merchant is made whole.

There’s the 3DS liability shift and there’s another way to shift liability

So what if you could let these additional orders through and not have the additional friction of 3-D Secure? In other words, what if you could still shift liability, while still providing a frictionless checkout experience?

This is where the new breed of guaranteed fraud prevention with a liability shift comes in. These solutions can take all orders and pass them to a big data, machine learning model that will append rafts of further third-party data and compare against historical and modeled data, to look for every which way an order can be approved — not declined.

Exceptional orders may also go into manual review where a dedicated team of domain experts can then add human intuition to search for reasons to approve these orders. These experts represent a specialist resource with the mission to look for reasons to approve. Every approved order is guaranteed against chargebacks should it turn out to be fraudulent.

And the key benefit? All this happens without the end-user journey being interrupted. All the user sees is their successful order and the goods as they arrive. And the retailers? They can focus on their core business of selling great products, accepting more orders and delighting customers, without the fear of fraud.

In the end, after all, shift matters.

Mike Cassidy, Signifyd head storyteller, contributed to the May 6, 2024 update of this blog post.

Photo by iStock

Want to explore financial liability shift for fraud? We can help.