With this article, we hope to provide insights into chargeback fraud, and show you how to protect yourself from chargebacks to safeguard your business’s finances and reputation. By decoding the complexities of chargeback fraud, you’ll be better equipped to challenge fraudulent disputes, fortify your merchant chargeback prevention strategies, and maintain healthier relationships with banks and payment processors.

What is chargeback fraud and how do I prevent it?

Welcome to the wild world of chargeback fraud — where consumers become self-serving renegades and hard-working merchants transform into skilled detectives. This, my friends, is a tale of deceit, persistence, and the power of technology. As a merchant, you may be familiar with the infamous “friendly fraud” or “first-party fraud,” and let’s face it, there’s nothing friendly about it.

Join us as we embark on a journey through the winding maze of the chargeback process. You’ll encounter its crafty villains, understand their insidious tricks, and see first-hand the devastating impacts they can have on your coffers. But don’t worry, this story doesn’t end in gloom. You’ll uncover incredible strategies and tools to shield your business from these marauding scammers.

We’ll dive into the rising tide of this issue, linking it to our new normal of booming e-commerce and the unintended fallout of a global pandemic. And as we wade through this murky water, we’ll also spotlight the potential strain on your relationships with banks due to a high volume of chargebacks. So buckle up for a fascinating exploration.

Let’s not forget about the good guys either — the cutting-edge AI technologies that work tirelessly in the background, using data to predict and prevent these dastardly deeds. We’ll look at the potential legal repercussions that face these fraudsters — because justice does have a way of catching up, doesn’t it?

Be prepared for an in-depth exploration of how chargeback fraud works, the cost of defending your business, and how to effectively equip yourself in this ongoing battle. Remember, knowledge is power and in the words of a wise man, “By failing to prepare, you are preparing to fail.”

How does the chargeback process work?

First, let’s go over how the chargeback process works. When a customer disputes a transaction, they contact their bank or credit card company to initiate a chargeback based on a specific reason: the charge was fraudulent, the item never arrived, the item was not as described, etc. The bank will then investigate the dispute and may issue a refund to the customer, reversing the payment made to the merchant.

The chargeback recovery process can be daunting for merchants.

The merchant will then receive a notice of the chargeback and can either accept it or dispute it. They typically have only 30 to 45 days to resolve the dispute, depending on the payment processor and issuing bank, a process known as chargeback recovery.

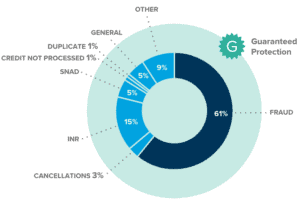

In the case of chargeback fraud, the customer files a false claim. Since it is usually apparent that the rightful cardholder actually did conduct the transaction, a customer with ill-intent will often rely on a common chargeback reason such as item not received (INR), item significantly not as described (SNAD) or unauthorized use of their credit card. Once the refund is issued, the customer keeps the product and the merchant is left with the loss.

Too many merchants don’t even bother to dispute a significant portion of chargebacks, leaving about $15 billion dollars per year unrecovered. It takes time and money and the typical unassisted win rate is an disappointing one in five. In 2022, Signifyd observed that merchants lost about 50 basis points on average in unrecovered chargebacks, which translates to 0.5% of revenue lost1.

What are the common types of chargeback fraud?

Fraud and non-fraud chargebacks alike can be costly for merchants – from the profit loss of the sale itself to needless authorization and processing fees, chargeback fines and time spent manually investigating claims.

There are several types of chargeback fraud, but some of the most common include:

False claims of non-receipt of merchandise (INR)

The customer claims they never received the product, even though it was shipped and delivered. This is known as an item not received (INR) chargeback.

Unauthorized use of a credit card (fraud)

The customer claims someone else made the purchase without their consent.

False claims of defective or damaged merchandise (SNAD)

The customer claims the product they received was faulty or damaged, even though it was in good condition when received. This kind of claim often labeled “significantly not as described” or SNAD.

What are key chargeback fraud concepts?

Banking relationships

A large number of chargebacks can impact on merchants’ relationships with banks or payment processors. If a merchant is constantly losing a large number of chargebacks, it can lead to higher fees or, in severe cases, a loss of the ability to accept certain types of payments.

Costs

Ecommerce fraud may be costing you more than you know. Every disputed chargeback has a cost in fees and administration. Fees can be between $15 and $100, regardless of the outcome of the dispute. Time and effort spent in administration can raise the cost to hundreds of dollars per challenged chargeback. Deciding at what value threshold to challenge chargebacks is a crucial choice for merchants. According to Signifyd data, the total cost of a fraudulent purchase of $100 is actually $196.2

A fraudulent chargeback represents much more than a lost sale for merchants. To quantify the total cost of fraud, we break down the many losses that accrue along the purchase journey of a fraudulent $100 sale.

Reason codes

Each chargeback has a chargeback reason code assigned to it, which is a two-digit number that corresponds to the reason the customer is disputing the charge. Understanding these codes can help merchants understand why chargebacks are being filed and how to prevent them in the future. Merchants can find a list of reason codes and their descriptions on the website of their payment processor or acquiring bank.

Merchant chargeback prevention services

Fraud protection providers and some payment processors offer chargeback prevention services, a kind of chargeback protection shield. Chargebacks are mostly prevented by declining risky orders or through improved customer service. Depending on the vendor, services can include various features such as real-time fraud screening and customer dispute resolution. However, increasing false declines is always a concern when orders are declined. Some services tied to merchant chargeback prevention may rely on a strategy to preemptively refund chargebacks on low-value purchases and take liability on the remainder. There is some risk in this strategy if fraudsters become aware of it.

Representment

If a merchant decides to dispute a chargeback, they can undertake the chargeback representment process, which includes documentation outlining the merchant’s case and providing evidence to support their claim. The issuing bank will review the documents and decide whether to reverse the chargeback and return the funds to the merchant. Chargeback representment can be a time-consuming and complicated process, so it’s important for merchants to understand the requirements and best practices for a successful representment.

Chargeback fraud is increasing

Chargeback fraud is often a complex and frustrating issue for merchants. Unfortunately, this type of fraud is becoming more common. When Signifyd surveyed consumers on their personal history with chargebacks and refunds, 21% said they had falsely claimed a package never arrived in order to obtain a refund, 22% said they falsely claimed an item was not as described and 25% said they’d requested a refund with the intent of keeping a satisfactory product and getting their money back.

Why is chargeback fraud on the rise?

There are reasons chargeback fraud is growing.

One of the primary reasons chargeback fraud is on the rise is due to the ease with which customers can dispute transactions. Chargeback rules and regulations are designed to protect customers from being financially damaged by fraud, but they can also be used by customers to get their money back for illegitimate reasons. Many merchants don’t have the resources or expertise to effectively fight chargebacks, which can make them an attractive target for fraudsters. Without a chargeback protection shield they are vulnerable.

Another factor contributing to the increase in chargeback fraud is the growth of ecommerce. With more consumers shopping online than ever before, there are more opportunities for legitimate cardholders to exploit the chargeback process.

The pandemic also played a role in the rise of chargeback fraud. When more people started shopping online there was an increase in delivery delays and lost packages. That caused an uptick in disputes over non-receipt of merchandise. Some consumers took advantage of the situation by falsely claiming that they never received a product in order to get a refund.

What can merchants do?

Given the prevalence and impact of chargeback fraud, it’s essential for merchants to take proactive steps to prevent and fight this type of fraud. In addition to the strategies outlined in the previous section, merchants can consider working with a fraud protection provider that offers chargeback protection, like Signifyd’s Complete Chargeback Protection. Chargeback protection providers offer a range of services, including chargeback alerts, chargeback representment and fraud detection tools.

How to prevent chargeback fraud

Chargeback prevention is the best way to fight chargeback fraud. Here are some strategies merchants can use to prevent online fraud, including chargeback fraud:

Actively prevent fraudulent purchases

Actively prevent fraudulent purchases

By using fraud-prevention systems such as the Address Verification System (AVS) and processes such as reviewing orders and matching billing and shipping addresses between purchase and shipping, merchants can prevent fraudulent purchases, putting chargeback fraud among chargebacks that do occur in better focus. Alternatively, merchants can try to prevent fraud and chargebacks before the purchase using 3D Secure to authenticate the purchaser. Technologies to prevent fraud chargebacks have evolved dramatically. Artificial intelligence and machine learning have become table stakes in the game of professional fraud protection, so merchants will want vendors with large sources of transaction data and well-trained and aligned models.

Discourage “friendly fraud”

Have return policies that are clear and easy to find for customers. Get delivery confirmation for shipped goods above a certain value. Maintain thorough records of all customer interactions and transactions.

Use a multilayered approach to fraud

Fraud prevention often requires a combination of different strategies, including manual review processes, machine learning algorithms, and rules-based systems.

Communicate with customers proactively

Keep customers informed of the status of their orders and provide tracking information so they can track their shipments. This can help avoid frustration over delays and disputes over non-receipt of merchandise.

Use enhanced transaction monitoring

Use fraud detection software to identify suspicious activity, such as high-velocity ordering, orders that are uncharacteristically large based on historical activity, orders sending a large number of the same product to the same address. One cautionary note: As with any suspicious order element, there could be a reasonable explanation for any of these. That’s why merchants today require a sophisticated solution.

Create education and awareness campaigns for customers

Educate your customers about the chargeback process and how it works. Encourage them to contact you first if there is an issue, rather than filing a chargeback with their card issuer.

How do I fight chargeback fraud?

If a chargeback is filed, it’s essential to respond quickly and correctly. Merchants should:

Respond to chargeback claims

Merchants should respond within the specified timeframe and provide as much information as possible to dispute the claim, when it is financially reasonable to do so.

Collect and present evidence

Merchants should provide all evidence, such as proof of delivery or customer correspondence, to support their case. Visa has recently announced changes to the specific chargeback evidence that merchants need to share with banks. Catch our Signifyd on-demand webinar Crimes & Cocktails: The compelling evidence to fight fraudulent chargebacks to learn more.

Work with banks and payment processors

Merchants should try to resolve disputes and challenge chargebacks directly with the processor or bank promptly.

Leverage an automated representment

Automation can decrease friction and time to resolution in the representment process. Compare vendor offerings to Signifyd’s Chargeback Recovery service.

What are the consequences of chargeback fraud?

Chargeback fraud has consequences.

Chargeback fraud isn’t only a risk to the merchant. It can have serious consequences for the perpetrator. Under U.S. federal Mail Fraud and Wire Fraud laws, fraudsters face the possibility of time in jail. Although not typical, in 2019 a Florida man was sentenced to 10 years in prison for misuse of credit card chargebacks to the tune of $9 million. In addition, fraudsters may face many other losses, including loss of professional licenses, loss of employment, prevention of employment in education or the government, trouble renting, and trouble receiving government services. Our commerce protection community loves stories about defeating fraudsters. Consequences happen.

Chargeback fraud is a serious issue for merchants, but not an insurmountable one. By understanding the causes of chargeback fraud, merchants can take steps to prevent and fight it. We hope you found the article useful. Reach out to request a demo.

If you are an online merchant evaluating commerce protection vendors, you might be interested in our free Commerce Protection Buyer’s Guide. This comprehensive guide outlines the evolution of commerce protection from fraud prevention and details the integral components of a commerce protection solution. Takeaway resources include:

- A sample RFI template to leverage in your evaluation process

- Tips on how to build a business case for a commerce protection solution

- How to evaluate ROI and understand the tools used to protect against fraud and chargebacks

- How to find the right solution for your business

Footnotes/sources

- Signifyd data.

- Signifyd data.