As the last ecommerce deadlines for delivery by Christmas pass this week, many ecommerce merchants are confronting a pleasant surprise: Late-season online orders are defying predictions of a delivery debacle that suggested last year’s “shipageddon” would look like a minor inconvenience.

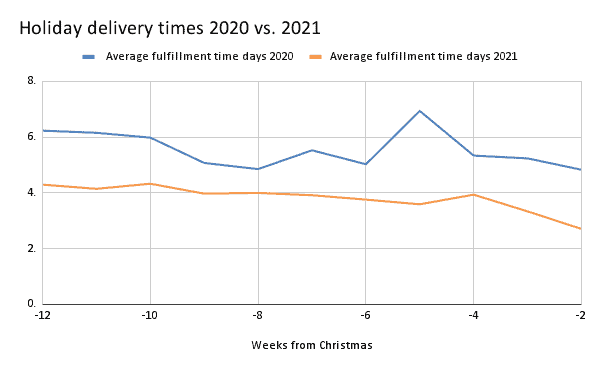

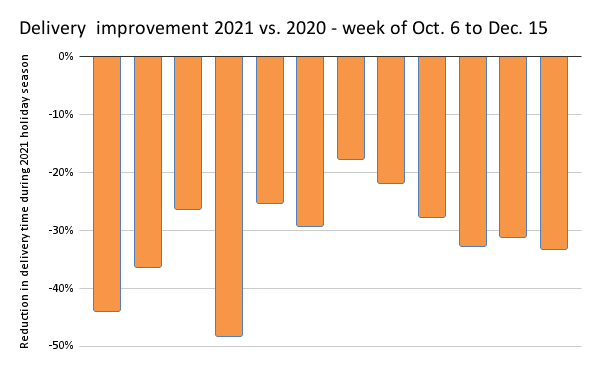

In fact, Signifyd’s fulfillment data shows that retailers have been gradually speeding up delivery times since October and that they made significant improvements during the Cyber Five weekend, the traditional start of the holiday shopping season.

The faster delivery times appear to have created a virtuous cycle of consumers reducing the number of orders they’re canceling and increasing the amount of online buying they are doing as Christmas Day approaches.

For instance, in early October, as the holiday shopping season approached, order cancellations were running well above last year’s figures, a function perhaps of consumers becoming frustrated with long waits for items to be delivered. But by the end of October, cancellations were numbering about the same as last year and they soon dropped below last year’s levels.

Canceled ecommerce orders are down more than 50% compared to last year

By last week, the value of orders canceled by consumers was 51% below its December 2020 level.

It would be reasonable to speculate that late-season delivery was going smoother than expected this year because merchants encouraged consumers to do their holiday shopping early to avoid supply chain disruptions and inventory shortages. If consumers completed their shopping early, the theory posited, there would be fewer packages to ship in December. But the data provides retailers with even better news on that count.

- Agile online retailers have managed to shave more than day off of early-season holiday fulfillment times and to dramatically improve on delivery times compared to last year.

- The predicted shipageddon redux did not materialize in 2021, despite supply chain disruption and concerns about inadequate inventory.

- While retailers encouraged consumers to complete their holiday shopping early in the season to avoid delays, consumers picked up their buying pace considerably in December without bogging down delivery systems.

Online sales are actually up significantly in the closing days of the holiday shopping season. Consumers may well have bought early, but it appears they are also buying often as Christmas closes in. In fact, through much of December, ecommerce sales on Signifyd’s Commerce Network have been running well ahead of last year’s impressive year-over-year growth.

Last week registered double-digit, year-over-year percentage increases in sales — including three days that topped 20% growth over 2020. The growth came at a crucial time, given that many retailers set mid-December deadlines to order gifts for standard delivery by Christmas.

Consumers appear confident about getting gifts there on time

The robust spending also no doubt says something about consumers’ confidence in the complex systems that get those gifts from a merchant’s warehouse or store to the gift recipient. It’s a confidence that likely grew from experience in recent weeks. Signifyd global data shows that from mid-November until last week, merchants shaved more than a day off the time it takes an order to go from purchase to delivery — clocking in at an average of about 2 ¾ days.

Moreover, 2021 fulfillment times consistently beat last year’s delivery times, which peaked in November 2020 at an average of nearly seven days. You might recall, the first pandemic Christmas brought about “shipaggedon,” when a surge in online buying flooded the key delivery services with millions of packages more than they had capacity for.

It will probably be weeks after the holiday rush before a complete analysis is available to explain the vast difference in fulfillment performance in 2020 over 2021. But early reports, including by The Wall Street Journal, have pointed out that retailers became more agile by shifting some deliveries to regional services, easing pressure on UPS, FedEx and the United States Postal Service.

COVID vaccines and increased automation helped keep packages moving

Shipping companies also benefited from big investments in capacity and the wide availability of COVID vaccines, the Journal reported, which helped keep workers healthy. The United States Postal Service and FedEx both added considerable automated facilities for the holiday, according to the Journal, with the post office increasing its daily delivery capacity by 35% and FedEx adding more than 12 new facilities and expanding 80 others.

UPS, meantime, revved up Saturday operations, allowing it to deliver six million packages a day, rather than as many as two million a Saturday last year, the Journal said.

The coming days remain crucial for retailers as last-minute shoppers stroll their aisle or pull up to their curbs to pick up orders. And the season of gift cards and returns is next up in January. But it seems that in the closing days of the 2021 holiday shopping season, retailers have plenty of fulfillment lessons to tuck away for their next shopping surge.

Photo by Mike Cassidy

Signifyd Data Analyst Phelim Killough contributed to this report.

Looking for ways to speed up your fulfillment times? Signifyd can help.