Retailers’ performance during the pandemic, and especially in the crucible of the COVID Christmas shopping season, has been nothing short of heroic.

They have handled historic spikes in order volume, strongly pivoted to, or launched, curbside pickup programs and managed the understandable anxiety of frontline retail workers who have kept their businesses and a vital sector of the economy running.

But retail is in for a reckoning. You can add Shipageddon and the weakness in retail’s fulfillment system to the list of trends that the coronavirus pandemic has accelerated. The extent of the challenge will become crystal clear late next week as shipping deadlines for Christmas Eve delivery come and go. It’s a harrowing time any holiday season, but this year it is especially stress-inducing.

Consider what’s already happened:

- Major delivery companies instituted surcharges for high volume shippers.

- UPS recently instructed drivers not to pick up orders from retailers that had exceeded their shipping projections, according to Bloomberg. This included some of retail’s biggest names, such as Gap, Nike and L.L. Bean, the news organization said.

- Macy’s turned to DoorDash to help pick up the slack, according to Bloomberg.

- Amazon placed limits on the number of orders third-party sellers can ship through its Fulfillment by Amazon offering.

- It’s become common for ecommerce sites to add red-letter warnings to their expected delivery dates, noting that COVID-19 might cause additional delays.

- Retailers are facing an unprecedented fulfillment challenge as they manage the holiday spike in ecommerce order automation on top of the dramatic surge prompted by the pandemic.

- One fulfillment expert says as many as 700 million packages are at risk of arriving after the winter holidays for which they were ordered.

- Online and omnichannel retailers will need to devise a new strategy going forward to handle a permanent increase in online orders while still competing successfully with Amazon.

Rob Garf, of Salesforce’s Retail & Consumer Goods practice did the math for Supply Chain Dive. Given the pandemic-plus-holiday spike in orders and the capacity of shippers, Garf estimated that as many as 700 million ecommerce packages are at risk of not arriving in time for the holiday.

True, these discouraging numbers are all based on a holiday season like none before. But something has to give. Order volumes will surely subside once the holiday season passes, but they are not returning to pre-pandemic levels, certainly not while the pandemic still rages and not even once it passes.

Consumers will be shopping more online for the foreseeable future

In fact, 76% of U.S. consumers and 77% of consumers in the UK have told Signifyd in a September survey that they had adopted new shopping habits in the time of COVID that they intend to continue once the health crisis passes. Prominent among those habits are buying online and curbside pickup or buy online pick up in-store, which consumers have enthusiastically embraced.

Online sales, for instance, were up 49% globally, 52% in the U.S. and 56% in Europe in November compared to 2019, according to Signifyd’s Ecommerce Pulse data. And 49% of consumers in the U.S. and 57% in the UK say they will be shopping more online at least through 2021.

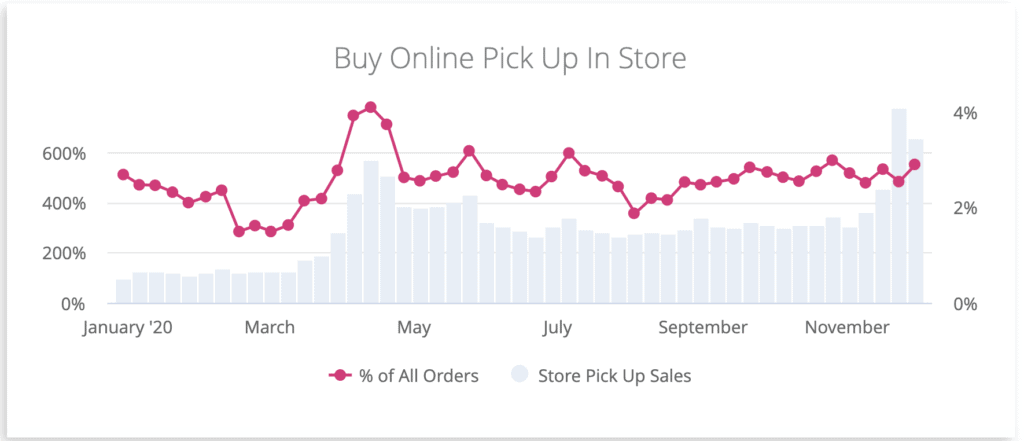

Curbside pickup and pick up in-store sales are up more than 500% since January, according to Signifyd Pulse data. In retail verticals — such as Leisure & Outdoor, Business Supplies and Grocery & Household Goods — the increase is even higher, ranging from seven- to 15-times higher.

No question curbside and pick up in-store take pressure off the strained fulfillment system, but the practices come with a downside. Like ecommerce itself, curbside and in-store pickup squeeze retailers’ already thin margins.

in a 2017 study using a $100 apparel purchase as an example, Retail consultancy AlixPartners broke down profit-per-channel this way: When a shopper buys that garment in a store, the retailer sees $32 in profit, once the cost of goods and operating costs are factored in. That sale online, assuming free shipping, nets the merchant $30. Factor in the added operational costs for buy online pick up in-store or at the curb and the margin shrinks to $23, according to AlixPartners.

The study is a bit of an old one and the example is specific to one retail vertical, but you get the idea. So where does all this leave retailers facing years ahead of dramatically elevated online orders?

The choices for handling Shipageddon long-range are not ideal

It leaves them with some tough choices in 2021, once the holiday season is behind them. And like all choices in retail, executives must make their decisions in the shadow of their mightiest competitor: Amazon. That said, let’s look at six possible paths to managing a fulfillment load that is bordering on the unmanageable. None is ideal, but maybe some combination will do. Or more likely, maybe some agile, innovative retailer will come up with the answer that is ideal.

- Bake higher shipping costs into pricing: Again, Amazon. Since the dawn of the ecommerce era, consumers have grown increasingly price conscious. Shoppers have more information than ever, with price comparison literally at their fingertips. A recent Profitero study found that on average, Amazon beats large retailers’ prices by an average of 15%. Consumers have already shown a willingness to abandon retailers for Amazon when the price is right. Still, this could be a winning strategy for a direct-to-consumer seller with products that are so compelling that consumers are willing to pay a premium.

- Charge, charge more or charge more often for shipping: Retailers with order value minimums for free shipping could consider lowering those minimums or charging more when shipping isn’t free. Retailers who don’t require a minimum purchase for free shipping could consider instituting minimums. But, we’ll say it again: Amazon. The Seattle behemoth has staggering resources and is able to operate at a loss in retail, if necessary, to maintain a competitive edge. This strategy seems feasible only for brands offering something Amazon doesn’t sell. And even then, it’s a risky proposition.

- Add fees for curbside pickup: Curbside comes with costs for retailers, but it doesn’t provide the same opportunity for impulse buys that pick up in-store offers. But curbside fees would threaten to kill the golden goose. The pandemic makes curbside look like the future. Better to explore marketing campaigns — email, promotions, etc. — that encourage impulse buys or future additional purchases from curbside customers. There are plenty of opportunities to interact online and in the back-and-forth communication concerning an order’s progress. It’s also likely that curbside margins will be improved as retailers new to curbside pickup design new efficiencies to bring costs down.

- Turn fulfillment over to Amazon: Amazon for years has been building a delivery business to move its own packages — with an eye on competing with UPS and FedEx for outside business, too. And, of course, there is Fulfillment by Amazon, which moves third-party sellers’ goods. One word of warning: Yikes. Amazon has shown itself to be a dangerous frenemy when it comes to competing retail fulfillment. In fact, FBS customers have been frustrated this holiday season by shipping limits placed on them by Amazon. Maybe turning to Amazon as a safety valve in exceptional times is worth taking a chance, but relying solely on a key competitor during peak shipping periods seems a dangerous bet.

- Create networks of retailers that either establish or turn to an Instacart-like model that they control: Retailers on their own already are turning to Uber, Instacart, Doordash and other upstart last-mile outfits to handle deliveries. Why not team up? There is power in a network of retailers when it comes to data collection and economies of scale. Ironically, there might be anti-competitive hurdles to clear here, but it’s worth exploring.

- Concede that two-day delivery isn’t sustainable: Surrender and do the work to communicate to consumers that the costs involved in fast delivery in our pandemic and post-pandemic world don’t pencil out. Maybe a tiered system, already in use in places, that will get items to shoppers fast for a price is the answer. Reserve free or low-cost shipping for orders consumers are willing to wait for. Have we mentioned Amazon? Yeah, it will continue to offer fast, free (or at least included with a Prime membership) shipping. Again, D-to-C sellers with close relationships with customers might be able to pull this off with clever, clear and transparent communication and spectacular products.

Of course, solving the challenge of shrinking margins isn’t an exercise retailers conduct in a silo. Improvements in other parts of the enterprise can make up for erosion in margins because of fulfillment pressures. Retailers that succeed in the post-pandemic era will no doubt explore the entire shopping journey — from discovery to post-purchase support — to find where revenue is leaking. Stopping those leaks is found money.

One sure thing amid the uncertainty: 2021 will represent a new era in commerce and the best in the retail business will discover new ways to excel in it.

Photo courtesy of Amazon

Data by Signifyd Business Analytics Team

We can help automate and protect your curbside pickup program.