After growing into the market leader in guaranteed merchant protection from chargebacks, Signifyd recently expanded its commerce protection beyond transactions to help merchants manage some of their most fraught customer experience challenges.

We think it’s worth talking about, with one of those who was highly involved in charting our new and broader path.

Signifyd’s new Chargeback Recovery means that merchants now have a solution that handles chargebacks throughout the buying journey — whether those chargebacks are a result of a sophisticated fraud attack or a customer who believes the product he or she received does not live up to its promise.

Elizabeth Force

Elizabeth Force, a strategy and operations leader at Signifyd, was part of a team that crafted the company’s solution to one of retail’s most nettlesome problems. Force sat down with us to answer a few of merchants’ most common questions about Signifyd’s newest product.

Q: As a Signifyd customer, I feel like I’ve got my chargebacks under control at the point of transaction. What other kind of protection do I need? Is there more that I can do to prevent chargebacks due to unauthorized use of a credit account?

A: Signifyd’s Chargeback Recovery spans the entire customer journey. Our latest product works beyond the checkout stage in the transaction, to fulfillment and post-purchase as well.

Our solutions include Fraud Protection. It uses big data, machine learning and domain expertise to sift fraudulent orders from good ones. And it provides a financial guarantee for orders we approve that later turn out to be fraudulent.

Chargeback Recovery addresses unnecessary revenue loss

Chargeback Recovery is our solution to help you address unnecessary losses later in the buying journey, for instance from SNAD, which is when a customer claims a chargeback item not as described.

Q: Fishy chargebacks — like a SNAD claim that is suspect, or when a customer reports that an item was not received INR after posting pictures of it on Facebook — those are really irritating. I feel like those online payment chargebacks come from people trying to take advantage of me. Why should I be concerned with the customer experience I provide for people who are trying to steal from me?

A: That’s the challenge with things like SNAD and INR, and other chargebacks that aren’t in the unauthorized use category. Those claims are a mix of valid consumer complaints and potentially abusive customers. It’s challenging to discern between the two. Our team of chargeback recovery experts has years of experience in ecommerce chargeback protection, and they use our AI-driven Guaranteed Fraud Protection technology to assess which of these merchant chargebacks are more likely to be abusive, versus a true customer complaint.

Q: Which technologies has Signifyd used in Guaranteed Fraud Protection, and how does that relate to these kinds of chargebacks?

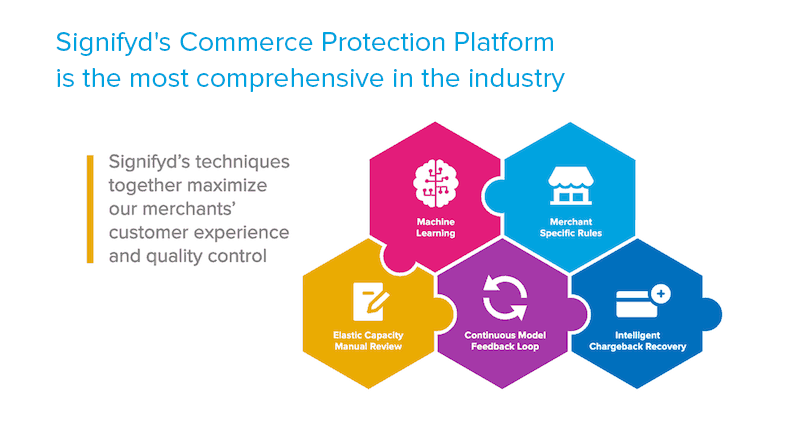

A: We combine three techniques, machine learning being the primary technology, and we add to that the additional flexibility to provide merchant specific rules and elastic manual review capacity to account for order spikes due to seasonality or marketing strategies.

Similar to Guaranteed Fraud Protection, Chargeback Recovery uses machine learning to assess multiple data fields to determine which chargebacks we should dispute, because they are likely from bad actors, and which chargebacks are actually valid customer complaints that need to be addressed by a merchant’s customer support experts.

Q: I’ve heard Signifyd talk about “adding elastic capacity to manual review.” What does that mean?

Elastic capacity allows effortless scaling for order spikes

A: Here’s an example: Over the holidays or during a new product launch, you want to run the most successful sales campaign possible. And when you succeed, you will see some pretty dramatic order surges. You don’t want to turn away paying customers, especially new customers coming to your brand for the first time.

In rare instances, where Signifyd can’t decide if a purchase is coming from a potentially bad actor, we have a manual review team in place to review those transactions and decide: Should we let these transactions happen or not?

Our elastic capacity means that Signifyd takes on the additional work of reviewing orders. You don’t need to worry about scaling your team internally. We have the resources to handle your manual review process.

Q: We put a lot of work into building our customer experience: investing in marketing and merchandising, attracting consumers to the site, getting the product in front of shoppers, enticing customers to buy the product. How is customer experience impacted by chargeback fraud that are spurred by SNAD, INR and customer misunderstandings?

A: You spend all those marketing dollars and build that beautiful front-end customer experience. And it works. You’ve acquired a new customer — and that customer actually made a purchase. Congratulations. That’s the hard part.

But you don’t want to break that customer experience after all you’ve done. If the customer really never received what they ordered, you don’t want to fight them on that chargeback automation. You want to be able to believe them. You need data to do that, but it can be done.

Be upfront about that with your customer experience team. You need to rely on your cost benefit analysis to help you decide whether it might be cheaper to resend this package as opposed to fighting a chargeback and creating a bad customer experience. Ultimately you want your customer to get product they want, the product that will inspire them to come back.

In the cases where you do have a potentially abusive customer or a customer chooses to file a chargeback, Signifyd has your back and helps address that chargeback for you.

Q: I’ve also heard that Signifyd has a different philosophy about pricing and charging merchants for this chargeback service. Can you talk about that?

A: Signifyd wants to be aligned with our customers on values and growth. We believe that as our customers grow, they should be growing with the healthiest possible revenue stream. Signifyd is here to enable that. That means we want you to have the cleanest transactions, customer experience, and revenue stream possible without chargebacks.

Our chargeback recovery product pricing is similar to our guaranteed fraud pricing model. In other words, when you prosper, we prosper. We don’t believe in a model that would reward us for the number or value of the chargebacks we fight for you. That misaligns our goals. Under that model, we would do better, the more chargebacks you have. Nobody wants you to have more chargebacks.

Signifyd’s solutions mean fraud and chargeback costs are consistent and predictable

Moreover, the combination of our solution and our pricing model, enables our customers to maximize their revenue and provide predictability in their cost structure in an otherwise unpredictable, fluctuating world of payments fraud and chargeback losses.

Q: What more can merchants do to avoid chargebacks?

A: With the addition of Signifyd’s Chargeback Recovery service, we now have one of the most, if not the most, comprehensive solutions in the industry when fighting chargebacks. We help you get recoverable revenue and avoid unnecessary losses.

We use three different decisioning techniques in our models: machine learning, merchant specific rules and elastic capacity manual review. When we combine the best of those three techniques, we are able to approve over 99 percent of orders.

Our seamless customer experience helps you meet your service level agreements, your SLAs for fulfillment times, and provides quality control through our elastic manual review team. Most other solutions in this space are using only one or two decisioning techniques.

With the addition of Chargeback Recovery to our Guaranteed Ecommerce Fraud Solution, Signifyd handles both fraud and non-fraud chargebacks. We are able to constantly improve our models by connecting that feedback loop. It’s one thing to make a decision with the rules in place, to decide if an order is good. Our service creates feedback that validates the model. This is key for improving your purchase approval rates and fraud-decisioning capabilities.

Q: Should I worry about so-called “friendly fraud?”

A: Everyone has a different definition for friendly fraud. Here’s how we see the issue:

For online retailers, 61 percent of losses come from fraud. The other 39 percent come from non-fraud chargebacks. Some categories have higher rates of INR and SNAD than others. Particularly with SNAD, fraud occurs more in categories where consumer knowledge is a key factor. Think about tools. Customers want to make sure they ordered the right part for their toolbox. Or take cosmetics. Shoppers want to order the right color foundation. If the product they receive doesn’t meet their expectations, it might not be your fault.

But whether it’s your fault or not, it’s a crucial moment for the quality of your customer experience. Signifyd is about helping our merchants create and maintain the best customer experience possible, throughout the entire customer journey. The goal is to realize increased customer lifetime value and create clean and repeatable revenue for your enterprise.

Feature photo by Victoria Heath on Unsplash