Despite fears of disrupted fulfillment and missed deadlines, ecommerce retailers delivered when it came to crunch time this holiday season, Signifyd’s Ecommerce Pulse data shows.

Online order fulfillment times were down considerably in December across a number of key retail verticals, Signifyd’s latest data analysis shows. The surprising trend was among a number of December findings that reveal a holiday season marked by generous spending, a blizzard of gift cards and a wave of fraud and policy-abuse attacks.

What kind of fulfillment improvements did brands deliver? The time it took home-goods retailers to fulfill orders in December plummeted by 78% from December 2020. Apparel retailers were filling orders in 55% less time than it took them to get the goods to customers last year. And health & beauty merchants knocked 48% off the time it took their orders to show up at customers’ homes.

In fact, retailers made steady improvement in delivery times throughout the holiday season and the trend continued through December. The snappy performance was a far cry from 2020’s shippageddon, which led to a significant number of gifts being delivered after Christmas. Signifyd data indicated that the improvement in shipping times limited the number of canceled orders retailers faced during the holiday season, which led to healthier top lines.

December’s numbers back up a number of pre‑holiday predictions

While the fulfillment figures were the most unexpected to surface in an analysis of Signifyd’s December data, a number of other statistics serve to confirm and quantify trends that ecommerce experts had predicted.

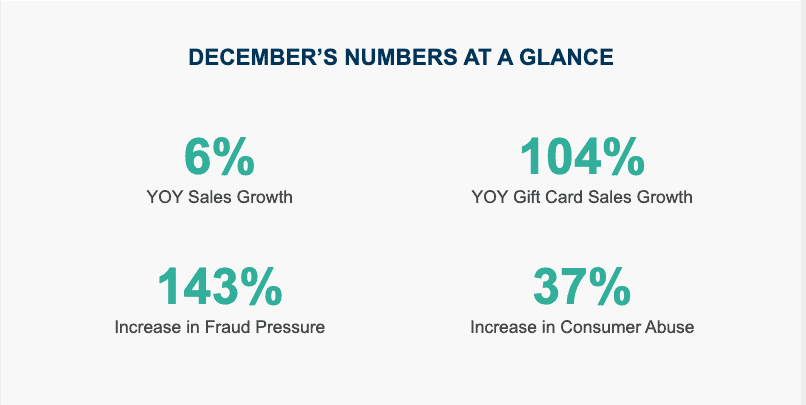

Remember how 2021 was going to be the year of the gift card? Gift card sales were up 104% in December, according to Signifyd Pulse data. We’re not saying holiday shoppers procrastinate, but you’ve got to admit, a gift card is a pretty great way to recover from that last-minute-my-mind-goes-blank-gift-buying panic.

Beyond procrastination, the surge in gift cards could have been a reaction to early supply chain worries and they might have been a reason fulfillment times didn’t run into the predicted trouble.

Simply put: Gift cards aren’t like physical goods that need to be moved from a warehouse to a distribution center to a home — easing concerns about supply and shipping bottlenecks. And they don’t need to be loaded on a truck for that last-mile trip, easing the volume delivery services had to deal with.

True to the pre-season hype, buy, now pay later transactions (BNPL) were also big in December. And there was evidence that the use of online installment payments was popular for both big-ticket items and typically less-expensive items. For instance, BNPL sales in the home goods vertical were up 52% year-over-year and up 63% in the health and beauty vertical.

All indications are that gift-givers were feeling particularly generous during the recent holiday season. Average order value in the sporting goods sector ticked up 16% in December over the year-ago period. Basket sizes in apparel were up 15%, home-goods order value increased by 14% on average and health and beauty climbed 11%.

Retail verticals do not rise and fall in lockstep

The variation in basket size in the different verticals is a good reminder that each vertical represents its own, little world. Yes, overall ecommerce performance is affected by a series of outside forces — seasonality, the economy, social trends, fraud pressure, abusive chargeback claims — but those levers act differently on different verticals at different times of the year. The trick, then, is to not overreact to changes by erecting barriers between willing buyers and the goods you offer.

Take December’s fraud pressure data, for instance. Ecommerce saw a 143% increase in fraud pressure over the previous year. Signifyd establishes fraud pressure by tracking the number of very high risk — and presumably fraudulent — orders on its Commerce Network. But that’s only part of the story.

If you dig into retail verticals, you’ll see that sporting goods faced only a 28% increase in fraud pressure, while wrestling with hikes in abusive non-fraud chargebacks. Item-not-received claims — or claims by consumers that items they ordered never showed up at their homes — increased 45% for the month. Significantly not as described chargeback (SNAD) claims — or claims that an item arrived in a condition distinctly different from how the retailer described it — were up 29% for sporting goods in December.

Apparel had a rough month in the abuse department

The story was the opposite and somewhat worse for apparel in the fourth quarter. Its SNAD or chargeback item not as described claims skyrocketed by 82% while its INR claims jumped 13%.

Finally, there was electronics, which saw a 21% increase in fraud pressure and a whopping 97% rise in consumer abuse, a measure that looks at INR and SNAD together.

In all, December’s numbers were another reminder that ecommerce trends continue to be difficult to predict, meaning it is more important than ever to be prepared for the unexpected.

Want to explore the seasonality of your business’ fraud pressure? We can help.