The tell-tale signs of January were evident in Signifyd’s Ecommerce Pulse data for the month, with certain categories of sporting goods putting in a strong showing and consumers demonstrating that the gift cards they received in late December were not going to waste.

In the month where resolutions are made to be broken, three key Sporting Goods subcategories that include hiking, camping and fishing gear; hobbies toys and media; and workout, sports and recreational equipment, were up year-over-year by 13%, 12% and 24% respectively. The increases perhaps indicate a pledge among some consumers to be more active, get outside more and generally engage in healthy pursuits. OK, maybe not so much when it comes to the hobbies, toys and media purchasers.

Meanwhile, shoppers armed with gift cards took to ecommerce to buy what they really wanted for Christmas, but didn’t necessarily get. Purchases made with gift cards in the home goods category were up 534%. And that’s from January 2021, when home goods sales via gift cards were up 192% year over year. Make a note: Maybe next year just get that special someone a couch.

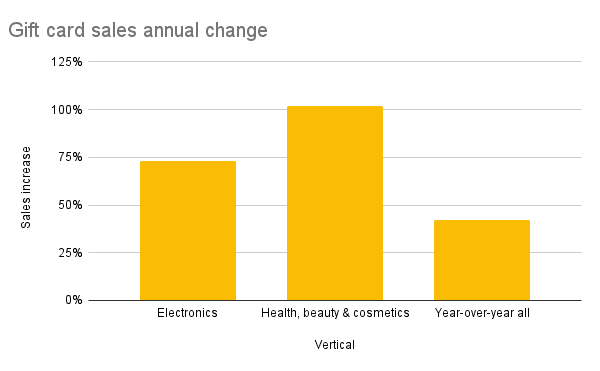

Consumers broke out the gift cards in January

Apparel was another strong gift-card category in January, as shoppers presumably took to their laptops and devices to buy outfits they actually would wear in public. Gift card transactions saw a 33% annual increase in the apparel vertical.

There was also sizable energy in January around the notion that it is better to give than it is to receive. The super-procrastinating crowd was online last month buying gift cards for some beyond-last-minute gift giving. If you’re still waiting for a present from your loved one, chances are you might be getting a gift card to treat yourself with some lip gloss, mascara, eye cream, hydrating moisturizer or some other health and beauty product. Sales of gift cards for Health, Beauty & Cosmetics products soared by 102% over a year ago.

Or maybe electronics are more your speed. There is hope there, too, as gift card sales in the vertical were up 73% last month, compared to January 2021.

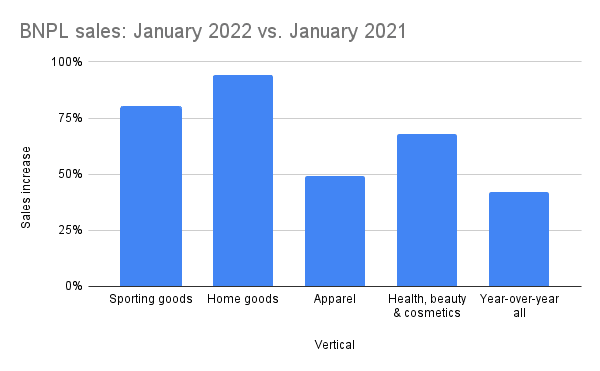

Throughout the 2021 holiday shopping period there was a lot of talk about how the season would be different — earlier start, fewer promotions, high gift-card sales due to supply chain concerns and a shopping season that would extend into early 2022 due to scarce inventory leaving shoppers disappointed — oh, and, that holiday 2021 would be the year of buy now, pay later (BNPL).

Shoppers were still gift buying in January

Those predicting the trends can find some validation in Signifyd’s January Pulse data. January’s data includes evidence that some shoppers were continuing to whittle down their gift-buying lists in January. We mentioned strong gift-card sales in health and beauty and electronics. In fact, the sale of gift cards online across all categories was up 42% year-over-year in January.

And buy now, pay later was on fire. Overall, sales relying on 2022’s answer to layaway were up 42%. Some verticals outperformed the broad average. BNPL sales in home goods soared to a height 94% above last January. Sporting goods experienced a 90% increase in purchases on an installment plan, while Health, Beauty and Cosmetics saw a 68% increases in BNPL sales. Not far behind was apparel, where buy now, pay later sales increased year-over-year by 49% for the month.

One other prediction was that fulfillment would be slow, both because of supply chain problems and because the high volume of online orders would once again choke the home-delivery ecosystem. Those who had bar bets counting on slow delivery and destroyed — or at least delayed — Christmas dreams had better pay up.

Retailers continued to deliver in January

January’s data shows that fulfillment times continue to drop — dramatically in some verticals — a trend that we first highlighted in December’s data. For all verticals, fulfillment time (the time from when the order is placed until it’s handed to the customer, tucked in their trunk or dropped at their door) was down 65% from January 2021. Home Goods deliveries were 71% faster and the time to have beauty and cosmetics in hand dropped by 75% year-over-year.

Overall, January showed signs that consumers were slightly shopped out, with total ecommerce sales dropping 10% compared to a year ago. That said, those who were shopping were especially enthusiastic. The average cart size in January nearly doubled over a year ago, topping out at a 90% increase.

On the dark side of the ledger, signs that fraud attempts and consumer abuse continued to rise were evident in Signifyd’s data. Overall fraud pressure in ecommerce increased 120% over January 2021. Signifyd calculates fraud pressure by tracking the change in the volume of orders that contain enough red flags to be presumed fraudulent.

Consumer abuse continued to climb at the start of 2022

Consumer abuse in its many forms saw an increase in a number of key verticals. False claims that an item arrived significantly not as described (SNAD) or chargeback item not as described in electronics were up 177% year over year. Claims that an items was not received, when it fact it was, climbed 54% in the Sporting Goods vertical while a measure of all forms of consumer abuse was up 61% in the electronics vertical.

As always, one month does not a trend make, but all indications are — judging from Month One of 2022 — that it will be another bumper year for ecommerce. But a year that will also come with its share of surprises.

Photo by Getty Images

Want to expand your payment options securely? We can help.